SYDNEY: The Australian and New Zealand dollars bounced on Thursday, as hopes for progress in US trade talks globally helped offset a more hawkish outlook on US interest rates that lifted the greenback overnight.

Risk assets received a boost after President Donald Trump posted there would be a news conference on Thursday to announce a deal with a “big” country, reportedly the UK.

That helped the Aussie rise 0.5% to $0.6456, paring a 1% loss suffered overnight which had knocked it from a five-month top of $0.6515.

The kiwi firmed 0.4% to $0.5966 , after slipping 1.1% the previous session.

Both had retreated after the Federal Reserve warned of two-sided risks to the economy and inflation, which led markets to scale back the chance of a June rate cut to just 20%, from 60% a week earlier.

The shift is partly due to expectations US tariffs will push up inflation in the short term, making it harder for the Fed to use rates to avoid an economic downturn. Longer term, this stagflation risk could be bearish for the greenback.

“It’s part of the apparent loss of US economic exceptionalism seen since the start of the year,” said Ray Attrill, head of FX strategy at NAB.

“There may also be a broader exodus from long USD positions underway, from exporters to the US previously happy to park receipts in USD deposits, or bond investors seeing returns on unhedged holdings going negative as the USD had fallen.”

As a result, Attrill has lifted his outlook for the Aussie to $0.6600 by mid-year and to $0.7000 by year-end.

Australian dollar hits new five-month top on US-China trade talks

Investors still assume the Reserve Bank of Australia (RBA) will cut its cash rate by 25 basis points to 3.85% when it meets on May 20, given a slowdown in inflation and softness in consumer spending.

Analysts at Goldman Sachs believe inflation will also be dragged down by Chinese exporters discounting prices on goods that would normally have gone to the United States.

“The lower path for inflation gives the RBA scope for further easing, particularly given the balance of risks around economic activity has also shifted to the downside,” they said in a note.

They expect cuts in May, July and August to take rates to a floor of 3.25%. Markets have rates at 3.0% or lower by the end of the year.

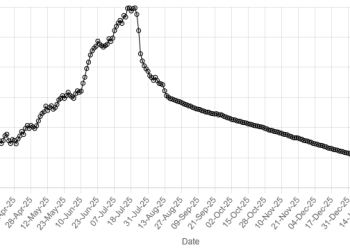

American Dollar Exchange Rate

American Dollar Exchange Rate