SYDNEY: The Australian and New Zealand dollars were weathering a bad case of whiplash on Friday having rallied from dizzying lows hit early in the week, but remain vulnerable to a relapse should looming US jobs data outpace expectations.

There is more than the usual uncertainty around the data as natural disasters and bad weather dogged January, while revisions to past numbers could see a steep downward shift in payrolls but also a record rise in household employment.

A strong outcome would likely lead the market to scale back expectations for US rate cuts and put the Antipodeans on the defensive again.

For now the Aussie was holding at $0.6282, just under $0.6296 resistance.

That left it up 1.2% for the week and well away from a five-year trough of $0.6088 hit on Monday. A break of $0.6330 is needed to extend the recovery.

The kiwi dollar was flat at $0.5675, off resistance at $0.5702.

It was 0.7% higher on the week and comfortably above Monday’s low of $0.5517.

The initial slide had followed President Donald Trump’s announcement of tariffs on Mexico and Canada, which turned into a rally when they were paused for a month.

“We are left in little doubt that much of the day-to-day volatility in AUD/USD will continue to be driven by tariff headlines,” said Ray Attrill, head of FX strategy at NAB.

Australia, NZ dollars struggle to extend gains amid brewing US trade war

He noted Trump’s review of trade policy was not due to report until April 1, so it would be some weeks before there might be some clarity on future tariffs.

At least bond markets had a good week, tracking a rally in Treasuries and helped by bumper demand at a sale of new Australian 2036 bonds.

The offer drew a record A$83 billion in bids, 46% of which were offshore.

Yields on 10-year paper were down 12 basis points for the week at 4.312%, the lowest since mid-December. Investors are also confident the Reserve Bank of Australia will cut its 4.35% cash rate when it meets on February 18.

Futures imply a 95% chance of an easing to 4.10%, and rates are seen around 3.50% by the end of the year.

The Reserve Bank of New Zealand is considered almost certain to cut its 4.25% cash rate by 50 basis points at its meeting on February 19.

It is then expected to shift to quarter-point cuts in April and July, with rates bottoming at 3.0% by October.

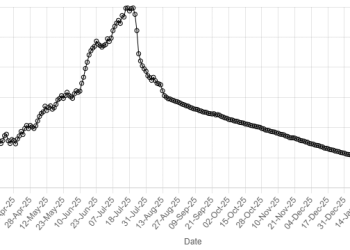

American Dollar Exchange Rate

American Dollar Exchange Rate