Australian shares touched a two-month high on Friday, on track for a seven-day rally, as gains in financials overshadowed the decline in gold-related stocks.

The S&P/ASX 200 index rose 0.5% to 8,188.40, as of 0050 GMT, hitting its highest level since March 5.

The benchmark is set for a third consecutive weekly gain.

Heavyweight banking stocks led gains on the benchmark, rising 0.8% to hit their highest level since February 19.

The sub-sector is on track for a third straight weekly gain.

The country’s ‘big four’ lenders rose between 1% and 1.5%. On the other hand, gold stocks lost 1.1%, on track for a weekly loss of more than 4%, and a fifth straight day of declines, as bullion slumped to a two-week low pressured by signals of softening Sino-US trade tensions and a holiday in top consumer China.

Technology stocks were up 0.4%, tracking gains in Wall Street peers, boosted by strong results from megacaps Microsoft and Meta easing concerns about artificial intelligence spending.

Energy stocks ascended 0.7%, as oil prices gained after US President Donald Trump threatened secondary sanctions on Iran.

Miners traded in a narrow range, last up 0.2%.

The world’s largest-listed miner BHP Group dropped 0.9%, while Rio Tinto and Fortescue gained 0.4% and 1.4%, respectively.

The sub-sector has fallen 0.6% for the week, after three straight weeks of gains.

Tech, real estate stocks lead Australian shares higher

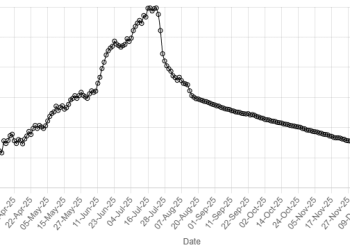

Locally, investors look ahead to the Reserve Bank of Australia’s two-day monetary policy meeting starting on May 19, where markets expect it to cut the cash rate to 3.60% from the current level of 4.10%.

As of May 1, 56% of market participants surveyed expect the central bank to cut rates to 3.60%, according to the RBA rate tracker.

Meanwhile, New Zealand’s benchmark S&P/NZX 50 index rose 0.3% to 12,192.45.