Australian shares extended losses for the second straight session, dragged down by commodity stocks, a day after the Federal Reserve signalled fewer interest rate cuts for next year.

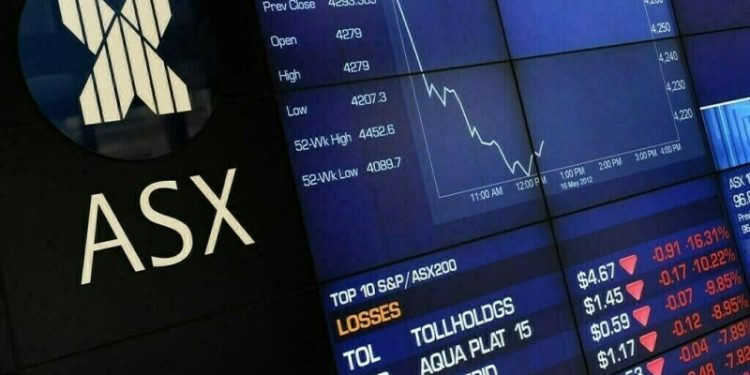

The S&P/ASX 200 index was down 1.1% at 8080.9 by 0025 GMT.

The benchmark was on track to record its worst week since mid-April, having lost 2.4% so far. The benchmark fell 1.7% on Thursday.

The US Federal Reserve cut interest rates by 25 basis points as expected on Wednesday, while revising its forecast for 2025, cutting the number of projected rate reductions to two from the four anticipated in September.

Australian shares drop 2% as Fed signals fewer rate cuts in 2025

In Sydney, financials sub-index dropped by 1.5% for the day, on track to record its fourth straight week of losses, with the “Big Four” banks down between 1% and 1.7%.

Miners lost 0.6% on the back of falling iron-ore prices as concerns about demand prospects in top consumer China and the US Federal Reserve’s outlook for interest rate cuts next year weighed on sentiment.

Mining behemoths BHP Group and Rio Tinto were down 0.7% and 0.3% respectively. Gold stocks lost 1.7%, with shares of St Barbara down 2.5%.

Sub-index leaders Northern Star Resources and Evolution Mining slipped 1.5% and 2.3% respectively.

In company news, conglomerate Wesfarmers said it would sell its industrial gas supply arm, Coregas, to Japanese multinational firm Nippon Sanso for A$770 million ($480.33 million).

Wesfarmers was down 1.7%. New Zealand’s benchmark S&P/NZX 50 index was flat at 12,753.74.