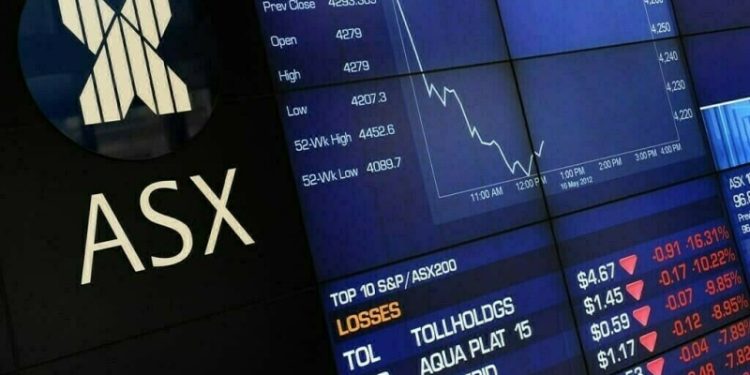

Australian shares hit a two-week low in early trade on Thursday, weighed down by miners and gold stocks as the US Federal Reserve’s cautious tone on rate cuts and softer commodity prices dampened investor sentiment.

The S&P/ASX 200 index was down 0.2% at 8516.2 by 0039 GMT, hitting its lowest level since June 4. The benchmark ended 0.1% lower on Wednesday.

Globally, investors assessed the Fed standing pat on its rates as the US central bank kept the doors open for two cuts this year.

However, the Fed Chair Jerome Powell struck a cautious tone as he said that inflation was expected to rise ahead with consumers paying more for goods due to Trump administration’s planned import tariffs.

Back on the bourse, miners fell 1%, hitting their lowest level since May 2 as iron ore prices fell on slowing demand for the steelmaking material in top consumer China.

Mining giant BHP Group shed 0.5% while iron ore miner Rio Tinto lost 0.1%. Gold stocks lost 1.7%, hitting their lowest level since May 22 as prices of the yellow metal fell after the Fed hinted at slower pace of future rate cuts.

Financials sub-index inched 0.3% higher, with the “Big Four” banks gaining between 0.2% and 0.7%. Among corporate news, the National Australia Bank had to fork out A$751,200 over alleged breaches of consumer data right rules. Shares of NAB rose 0.7%.

Energy stocks declined 0.7% despite an increase in oil prices.

Energy stocks lift Australian shares; Santos jumps on $18.7bn takeover bid

Oil and gas major Woodside Energy fell 1.2% and smaller peer Santos lost 0.3%.

New Zealand’s benchmark S&P/NZX 50 index was largely unchanged at 12,600.23 points.

The country’s economy grew faster than expected in the first quarter, thus giving the central bank more time to consider when it needs to cut interest rates again.

American Dollar Exchange Rate

American Dollar Exchange Rate