LONDON: Copper availability in the London Metal Exchange’s registered warehouses fell by 22% to the lowest in six months, LME data showed on Tuesday, as metal continues to flow to the U.S.

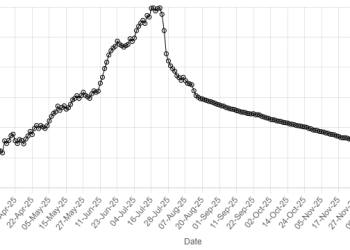

On-warrant LME copper inventories – those that have not been earmarked for withdrawal – dropped to 89,725 metric tons, down from 115,150 a day earlier and the lowest since July 10 last year, according to the data.

The drop occurred after traders notified the LME they planned to withdraw 30,200 tons of copper, mostly from LME warehouses in South Korea and Taiwan.

Traders have been taking copper stocks from LME warehouses and sending them to the U.S., where the metal commands a premium due to speculation ahead of a decision later this year about imposing U.S. tariffs on refined copper.

Benchmark LME copper prices soared to records above $13,000 a ton last week, driven by fears of shortages.

Inventories in U.S. Comex warehouses have surged by 444% over the last 12 months to 520,441 short tons.

The build-up of copper in the U.S. has created shortages elsewhere in the world, which are reflected in the spreads on the LME.

The premium of LME cash copper over the three-month contract climbed to $64 a ton on Tuesday, the highest in a month and up from $3 a week ago.