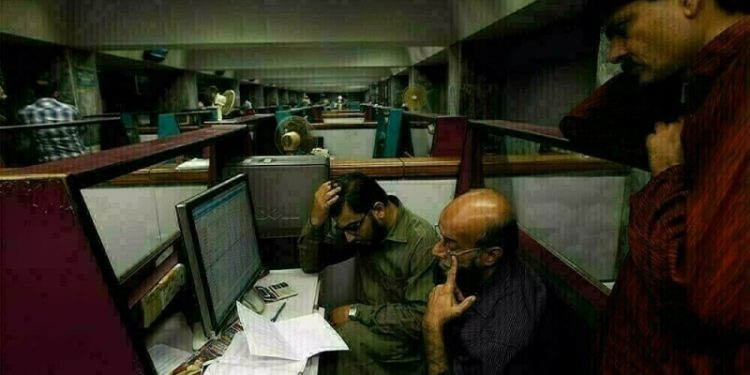

It was yet another day of massive selling at the Pakistan Stock Exchange (PSX), as equities entered a correction phase, with the benchmark KSE-100 Index closing around 106,200 after a historic single-day loss of 4,795 points on Thursday.

The loss comes a day after stocks suffered the then-worst-ever single-day decline of 3,790 points.

In the last three sessions alone, the stock market has lost nearly 10,000 points from its historic high of 116,169.41 reached on December 16, 2024.

Meanwhile, selling pressure persisted throughout the trading session, dragging the benchmark index to an intra-day low of 106,075.53.

At close, the KSE-100 settled at 106,274.97 level, a decrease of 4,795.32 points or 4.32%.

Sectors including chemical, commercial banks, power generation and refineries experienced selling pressure. Index-heavy stocks including MARI, HUBCO, NRL, HBL, NBP, MCB and UBL traded in the red.

The development comes after the PSX witnessed massive selling on Wednesday as well. Investors resorted to profit-taking with the benchmark KSE-100 Index closing at just over 111,000 after a historic single-day loss of 3,790 points.

“It is possible that the negative trend continues today,” said Intermarket Securities Limited in a note.

“Having said that, further downside creates buying opportunity, especially for those investors who missed the recent leg of the rally since late November. Most driving factors for the market – liquidity, falling interest rates and low political noise – remain intact.”

The market opened negative on Thursday before recovering. However, the upside was short-lived as investors resorted to profit-taking soon after, throwing the index deep into the red again.

Saad Hanif, Head of Research at Ismail Iqbal Securities, told media that the correction was overdue “as the stock market had witnessed a non-stop rally.”

“It is a good opportunity for buying as scrips have once again become attractive,” he added.

In a key development, the government on Wednesday introduced a money bill, “Tax Laws (Amendment) Bill, 2024,” in the National Assembly to further tighten the grip on non-filers and to generate financial resources for economic development.

Under the said bill, non-filers will be prohibited from purchasing, booking, registration of vehicles over 800cc, acquiring property beyond a specified limit, and making stock purchases beyond a certain threshold.

Globally, Asian stocks slid, bond yields rose and the dollar was perched near a two-year high on Thursday after the US Federal Reserve cautioned it would ease the pace of rate cuts in the coming year and investors braced for a Bank of Japan policy decision.

The Fed cut interest rates on Wednesday as expected, but Chair Jerome Powell’s explicit references to the need for caution from here on sent US stocks sharply lower, with Treasury yields surging and traders scaling back bets on rate cuts next year.

The Dow Jones Industrial Average, plunged more than 1,000 points.

Asian stocks have taken the cue from Wall Street, with MSCI’s broadest index of Asia-Pacific shares outside Japan down 1%. Japan’s Nikkei, fell 1.8%, while Australian shares, tab slid more than 2%.