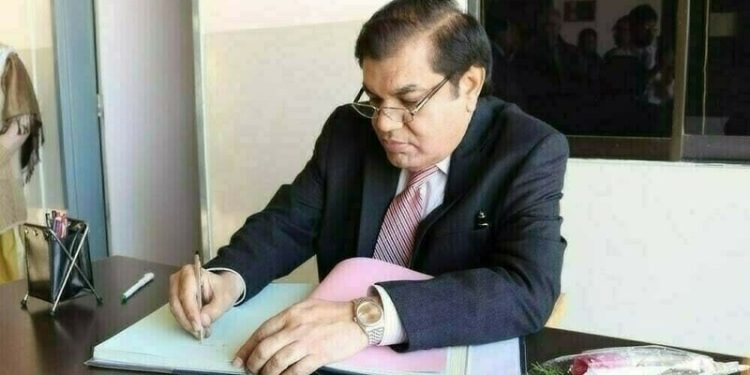

KARACHI: The Chairman of National Business Group Pakistan, President of the Pakistan Businessmen and Intellectuals Forum, President of All Karachi Industrial Alliance, Chairman of the FPCCI Advisory Board, Mian Zahid Hussain, while reacting to the budget said the total size of the budget has been fixed at Rs 17,573 billion and priority had been given to defence, interest payments on debt, and revenue generation.

He said that the federal and provincial governments are expected to spend Rs 3,800 billion on public welfare projects.

Mian Zahid Hussain acknowledged that the budget attempts to strike a balance between national security, internal stability, and fiscal responsibility. However, he expressed concern over several aspects that may negatively affect the general public, business community, and investors.

Speaking to the business community, the veteran business leader said that imposing taxes on vital sectors, such as renewable energy, could hamper the country’s economic momentum.

The proposed 18 percent sales tax on the import of solar panels is a regressive measure that will obstruct the growth of alternative energy sources, he warned.

Mian Zahid Hussain pointed out that several items have become more expensive under the new budget, including automobiles, petroleum products, beverages, mineral water, pet food, coffee, and chocolates.

The increased levies and carbon taxes on petroleum products are expected to burden daily life, especially for the middle class and salaried segments of the population.

This could potentially create financial strain for many, a concern that the business leader shares.

Mian Zahid welcomed the increase in defense expenditure, calling it a necessary response to India’s recent hostility and aggressive military posture. He termed investment in national security as unavoidable.

He stressed that to accelerate development in education, health, and social welfare sectors, the government must encourage impact financing.

While acknowledging that tax reforms and digital monitoring systems can help improve revenue collection, he cautioned that such measures would only be effective if taxpayers are also provided with corresponding facilitation.

He welcomed the introduction of a simplified income tax return form, particularly addressing long-standing demands of SMEs and salaried individuals.

Referring to the incentives provided in the housing and real estate sectors, including reforms in the mortgage system, he noted that this could encourage investment and potentially lower the cost of small houses and flats, a welcome development for the general public.

These incentives could stimulate the real estate market and make housing more affordable for the middle class.

He said that while the modest increase in salaries and pensions may not fully meet public expectations, it should still provide some relief amid the ongoing inflationary pressure.

Mian Zahid termed the tax collection target of Rs 14,100 billion as extraordinary, noting that it is 20 percent higher than the actual collection in the previous budget. Achieving this target without broadening the tax base will be difficult, he said, yet necessary for long-term economic stability.

He further stated that the imposition of carbon levies on petrol, diesel, and furnace oil would push prices even higher, thereby aggravating inflation and indirectly impacting both the economy and the people.

In conclusion, Mian Zahid Hussain stated that the budget does reflect efforts toward stability, but long-term, sustainable growth requires strategic depth, vision, and protection of renewable energy, online businesses, and social sectors.

He urged the government to allocate funds in the budget to safeguard these areas, thereby strengthening the country’s economic foundations. The need for these strategic reforms is urgent, and Mian Zahid Hussain’s call for action is clear.

KARACHI: The Chairman of National Business Group Pakistan, President of the Pakistan Businessmen and Intellectuals Forum, President of All Karachi Industrial Alliance, Chairman of the FPCCI Advisory Board, Mian Zahid Hussain, while reacting to the budget said the total size of the budget has been fixed at Rs 17,573 billion and priority had been given to defence, interest payments on debt, and revenue generation.

He said that the federal and provincial governments are expected to spend Rs 3,800 billion on public welfare projects.

Mian Zahid Hussain acknowledged that the budget attempts to strike a balance between national security, internal stability, and fiscal responsibility. However, he expressed concern over several aspects that may negatively affect the general public, business community, and investors.

Speaking to the business community, the veteran business leader said that imposing taxes on vital sectors, such as renewable energy, could hamper the country’s economic momentum.

The proposed 18 percent sales tax on the import of solar panels is a regressive measure that will obstruct the growth of alternative energy sources, he warned.

Mian Zahid Hussain pointed out that several items have become more expensive under the new budget, including automobiles, petroleum products, beverages, mineral water, pet food, coffee, and chocolates.

The increased levies and carbon taxes on petroleum products are expected to burden daily life, especially for the middle class and salaried segments of the population.

This could potentially create financial strain for many, a concern that the business leader shares.

Mian Zahid welcomed the increase in defense expenditure, calling it a necessary response to India’s recent hostility and aggressive military posture. He termed investment in national security as unavoidable.

He stressed that to accelerate development in education, health, and social welfare sectors, the government must encourage impact financing.

While acknowledging that tax reforms and digital monitoring systems can help improve revenue collection, he cautioned that such measures would only be effective if taxpayers are also provided with corresponding facilitation.

He welcomed the introduction of a simplified income tax return form, particularly addressing long-standing demands of SMEs and salaried individuals.

Referring to the incentives provided in the housing and real estate sectors, including reforms in the mortgage system, he noted that this could encourage investment and potentially lower the cost of small houses and flats, a welcome development for the general public.

These incentives could stimulate the real estate market and make housing more affordable for the middle class.

He said that while the modest increase in salaries and pensions may not fully meet public expectations, it should still provide some relief amid the ongoing inflationary pressure.

Mian Zahid termed the tax collection target of Rs 14,100 billion as extraordinary, noting that it is 20 percent higher than the actual collection in the previous budget. Achieving this target without broadening the tax base will be difficult, he said, yet necessary for long-term economic stability.

He further stated that the imposition of carbon levies on petrol, diesel, and furnace oil would push prices even higher, thereby aggravating inflation and indirectly impacting both the economy and the people.

In conclusion, Mian Zahid Hussain stated that the budget does reflect efforts toward stability, but long-term, sustainable growth requires strategic depth, vision, and protection of renewable energy, online businesses, and social sectors.

He urged the government to allocate funds in the budget to safeguard these areas, thereby strengthening the country’s economic foundations. The need for these strategic reforms is urgent, and Mian Zahid Hussain’s call for action is clear.