Bullish momentum was observed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index closing with a gain of over 1,000 points on Monday.

Buying was witnessed throughout the trading session, which pushed the index to an intra-day high of 111,622.72.

At close, the benchmark index settled at 111,377.96, a gain of 1,055.03 points or 0.96%.

Buying was observed in key sectors including power generation, OMCs, oil and gas exploration companies, fertiliser, commercial banks and automobile assemblers. Index-heavy stocks including HUBCO, SHEL, SNGPL, MARI, OGDC, HBL and UBL traded in the green.

“Many stocks have reached attractive levels and there could be some fresh buying at these levels. Nonetheless, the near-term market may continue to grapple with low liquidity,” Intermarket Securities in a note on Monday.

“The next International Monetary Fund (IMF) Review remains a key milestone to cross and may revive investor sentiment,” it added.

During the previous week, PSX remained under severe selling pressure and closed in deep red with heavy losses. The benchmark KSE-100 index plunged by 3,932.79 points on a week-on-week basis and closed at 110,332.94 points.

Internationally, Asian shares dithered and the US dollar edged higher on Monday after US President Donald Trump warned more tariffs were imminent including on steel and aluminium, an inflationary move that could limit the scope for rate cuts.

Speaking to reporters on Air Force One, Trump said he would announce on Monday 25% tariffs on all steel and aluminium imports into the US, and reveal other reciprocal tariffs on Tuesday or Wednesday.

China’s retaliatory tariffs on some US exports are due to take effect on Monday, with no sign as yet of progress between Beijing and Washington.

MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.1%, while Japan’s Nikkei went flat.

South Korea’s main index fell 0.2%, led by losses in steel makers.

Chinese blue chips were little changed, with worries about deflation soothed by data showing consumer inflation accelerated to its fastest in five months in January.

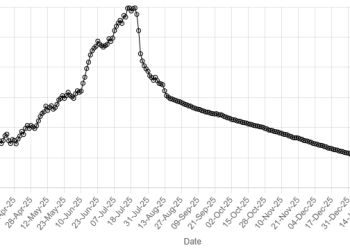

Meanwhile, the Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.06% in the inter-bank market on Monday. At close, the currency settled at 279.22 for a loss of Re0.17 against the greenback, according to the State Bank of Pakistan (SBP).

Volume on the all-share index increased to 415.16 million from 299.68 million recorded in the previous close.

The value of shares rose to Rs23.95 billion from Rs15.62 billion in the previous session.

B.O.Punjab was the volume leader with 55.94 million shares, followed by WorldCall Telecom with 34.12 million shares, and Cnergyico PK with 18.74 million shares.

Shares of 429 companies were traded on Monday, of which 198 registered an increase, 172 recorded a fall, while 59 remained unchanged.

American Dollar Exchange Rate

American Dollar Exchange Rate