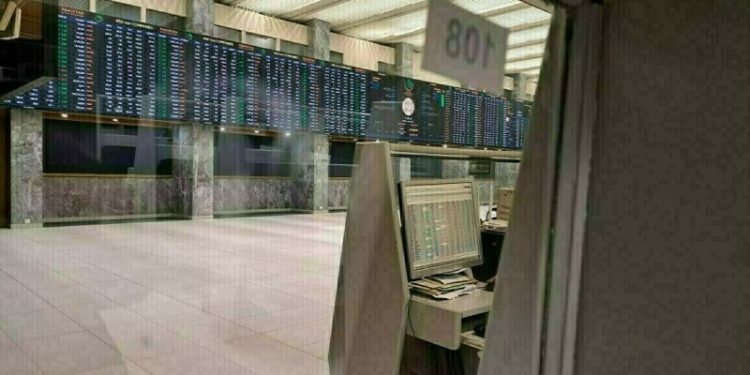

Buying momentum was observed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining over 600 points during the opening minutes of trading on Friday.

At 9:35am, the benchmark index was hovering at 120,609.85 level, an increase of 607.26 points or 0.51%.

Across-the-board buying was seen in key sectors including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks including PRL, HUBCO, PSO, SNGPL, MARI, OGDC, POL, PPL, NBP, MEBL and UBL traded in the green.

On Thursday, the PSX experienced another downbeat trading day, with most key indices registering declines despite some individual company gains. The KSE-100 index dropped by 463.34 points or 0.38% to end the day at 120,002.59.

Globally, share markets in Asia struggled for direction on Friday as fears of a potential U.S. attack on Iran hung over markets, while oil prices were poised to rise for a third straight week on the escalating Israel-Iran conflict.

Overnight, Israel bombed nuclear targets in Iran, and Iran fired missiles and drones at Israel as a week-old air war intensified with no sign yet of an exit strategy from either side.

The White House said President Donald Trump will decide in the next two weeks whether the U.S. will get involved in the Israel-Iran war. The U.S. President is facing uproar from some of his MAGA base over a possible strike on Iran.

Brent fell 2% on Friday to $77.22 per barrel, but is still headed for a strong weekly gain of 4%, following a 12% surge the previous week.

Still, a cautious mood prevailed in markets with Nasdaq futures and S&P 500 futures both 0.3% lower in Asia. U.S. markets were closed for the Juneteenth holiday, offering little direction for Asia.

The MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.1% but was set for a weekly drop of 1%. Japan’s Nikkei slipped 0.2%.

China’s blue chips rose 0.3%, while Hong Kong’s Hang Seng gained 0.5%, after the central bank held the benchmark lending rates steady as widely expected.

In the currency markets, the dollar was on the back foot again,

slipping 0.2% to 145.17 yen after data showed Japan’s core inflation hit a two-year high in May, which kept pressure on the Bank of Japan to resume interest rate hikes.

Investors, however, see little prospect of a rate hike from the BOJ until December this year, which is a little over 50% priced in.

This is an intra-day update