A strong buying rally was witnessed at the Pakistan Stock Exchange on Monday, as the benchmark KSE-100 Index surged by over 3,900 points to settle well above 115,000 level.

Positive momentum persisted throughout the trading session, with the benchmark index hitting an intra-day high of 115,422.34.

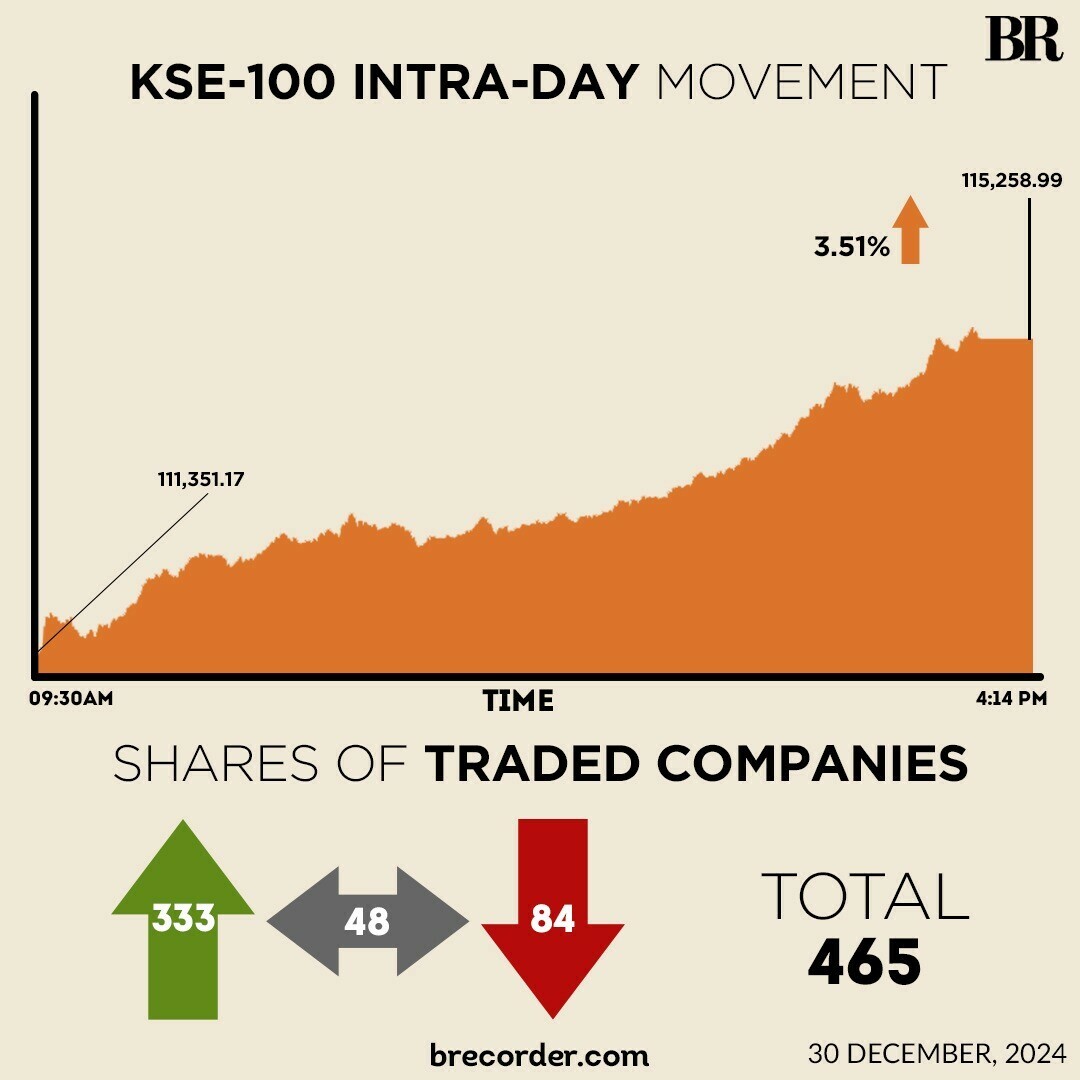

At close, the KSE-100 settled at 115,258.99, an increase of 3,907.82 points or 3.51%.

Across-the-board buying was witnessed in key sectors including automobile assemblers, cement, chemical, commercial banks, fertilizer, oil and gas exploration companies, OMCs and power generation. Index-heavy stocks including HUBCO, OGDC, MARI, PPL, POL, PSO, SNGPL, HBL, MEBL, NBP and MCB traded in the green.

During the outgoing year, PSX has emerged as the top performer among Pakistan’s asset classes in 2024, with the benchmark KSE-100 Index up 78%, making it the second-best performing market globally after Argentina, said Topline Securities in a report.

“Over the past 18 months, the PSX delivered a 177% USD return (169% in PKR), driven by macroeconomic stabilization and improvements in external accounts,” it said.

However, despite the rally, PSX’s market capitalization is still $50 billion, half of its 2017 peak of $100 billion.

“This decline is due to PKR devaluation, large dividend payouts, and fewer listings,” read the report.

During the previous week, PSX witnessed a bullish trend and closed on a positive note with healthy gains on the back of fresh buying on available attractive low levels. The index surged by 1,838.03 points on a week-on-week basis and closed at 111,351.18 points.

Globally, Asian shares edged lower on Monday as high Treasury yields challenged lofty Wall Street equity valuations while underpinning the US dollar near multi-month peaks.

Volumes were light with the New Year holiday looming and a rather bare data diary this week. China has the PMI factory surveys out on Tuesday, while the US ISM survey for December is due on Friday.

MSCI’s broadest index of Asia-Pacific shares outside Japan, dipped 0.2% but is still 16% higher for the year. Japan’s Nikkei eased 0.2% but is sitting on gains of 20% for 2024.

South Korea’s main index has not been so fortunate, having run into a storm of political uncertainty in recent weeks, and is saddled with losses of more than 9% for the year. It was last off 0.35%.

S&P 500 futures and Nasdaq futures were both off 0.1%. Wall Street suffered a broad-based sell-off on Friday with no obvious trigger, though volumes were just two-thirds of the daily average.

Meanwhile, the Pakistani rupee remained largely stable against the US dollar, depreciating 0.01% in the inter-bank market on Monday. At close, the currency settled at 278.48 for a loss of Re0.10 against the greenback.

Volume on the all-share index increased to 1,059.02 million from 815.92 million on Friday.

However, the value of shares declined to Rs40.89 billion from Rs32.92 billion in the previous session.

Cnergyico PK was the volume leader with 125.61 million shares, followed by WorldCall Telecom with 111.55 million shares, and B.O.Punjab with 84.18 million shares.

Shares of 465 companies were traded on Monday, of which 333 registered an increase, 84 recorded a fall, while 48 remained unchanged.