Buying rally continued at the Pakistan Stock Exchange (PSX), with the KSE-100 Index gaining nearly 2,200 points as the market displayed renewed investor confidence.

Bullish sentiment dominated throughout the trading session, with the index gaining momentum after midday and closing near the session high.

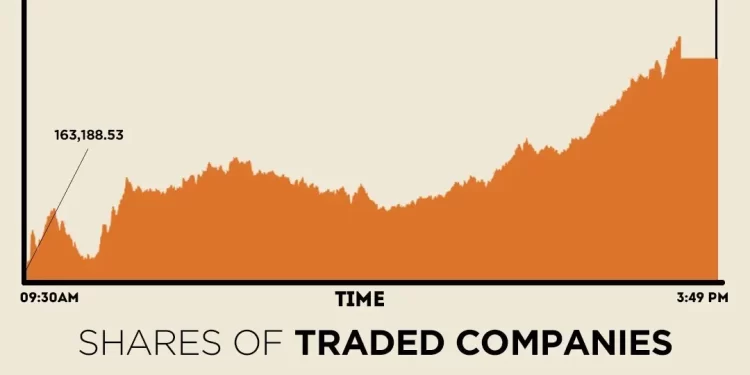

At close, the KSE-100 Index settled at 165,373.31, up 2,184.78 points or 1.34%.

“The banking sector stole the spotlight in today’s session, with MEBL, HBL, UBL, and MCB all closing higher than their previous levels, supported by healthy volumes,” brokerage house Topline Securities said in its post-market report.

In the E&P sector, OGDC and PPL were not far behind, as both stocks attracted investor interest and closed firmly in the green, it added.

Key index heavyweights – MEBL, LUCK, PPL, OGDC, and ENGRO – acted as the main drivers of the rally, together contributing around 942 points to the benchmark’s overall gain, Topline said.

Speaking at the Pakistan Business Council’s Dialogue on the Economy 2025, Muhammad Aurangzeb on Wednesday projected 3.5% economic growth for Pakistan this year, with a 4% growth forecast over the next two to three years and potential for 6-7% growth in the medium term, contingent on sustained progress in agriculture, manufacturing and services.

On Wednesday, PSX closed on a firm note as strong institutional buying in heavyweight stocks lifted all major indices despite lingering caution across the broader market. The benchmark KSE-100 Index surged by 1,496.04 points, or 0.93%, to close at 163,188.53.

Globally, Asian stocks rose on Thursday, and the dollar was soft on growing expectations of an interest rate cut from the Federal Reserve next month, while the yen remained on intervention watch, with traders weighing the prospect of a rate hike before year-end.

A holiday-curtailed week has led to limited moves across markets, with stocks keeping a largely upbeat tone and currencies much more sedate as investors shrug off AI bubble worries that had roiled equities earlier in November.

The US markets are closed for the Thanksgiving holiday on Thursday and are due to trade for a short session on Friday.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.4% higher, tracking gains from Wall Street and on course to snap a three-week losing streak. Japan’s Nikkei and South Korea’s Kospi surged over 1%.

Meanwhile, the Pakistani rupee saw a slight improvement against the US dollar in the inter-bank market on Thursday. At close, the local currency settled at 280.55, a gain of Re0.01 against the greenback.

Volume on the all-share index decreased to 498.36 million from 636.41 million recorded in the previous close. The value of shares declined to Rs30.59 billion from Rs30.92 billion in the previous session.

Dost Steels Ltd was the volume leader with 48.39 million shares, followed by WorldCall Telecom with 36.70 million shares, and Beco Steel Ltd with 25.11 million shares.

Shares of 484 companies were traded on Thursday, of which 289 registered an increase, 152 recorded a fall, and 43 remained unchanged.