After days of selling pressure, positive sentiments returned to the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index closing with a gain of nearly 1,500 points on Wednesday.

The bourse opened on a positive note and maintained bullish momentum throughout the trading session, pushing the index to an intra-day high of 163,397.24.

At close, the benchmark index settled at 163,188.53, an increase of 1,496.04 points or 0.93%.

“Although the market opened on a volatile note, sustained institutional buying later in the session provided much-needed stability and momentum,” brokerage house Topline Securities said in its post-market report.

Key index heavyweights – FFC, MEBL, HBL, NBP, and OGDC – acted as the primary engines of this rally, collectively contributing around 1,058 points to the benchmark’s overall advance, it added.

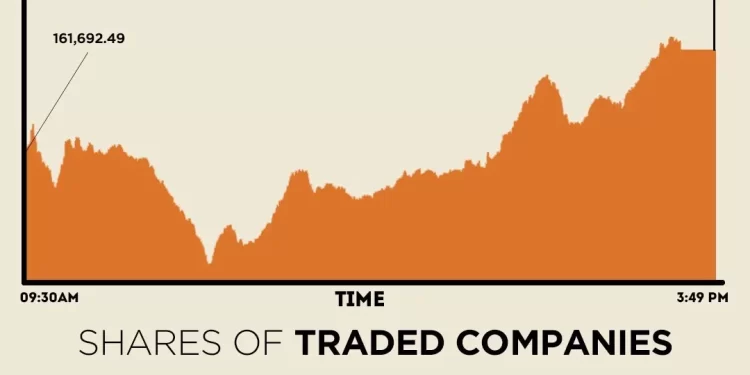

On Tuesday, PSX closed lower as profit-taking in major index-heavy sectors dragged the market into negative territory, even as overall trading activity strengthened. The benchmark KSE-100 Index lost 291.59 points, or 0.18%, to settle at 161,692.49.

Globally, Asian stocks rose on Wednesday, chasing gains on Wall Street as weaker-than-expected economic data spurred expectations that the Federal Reserve will cut interest rates at its policy meeting next month.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 1%, after US stocks ended the previous session with mild gains. Japan’s Nikkei stock index tacked on 1.8%, while US stock futures edged up 0.2%.

US stocks reclaimed lost ground after a selloff earlier this month, with the S&P 500 and Nasdaq Composite rising for a third consecutive day on Tuesday after data showed retail sales rose less than expected and consumer confidence weakened, firming up expectations that the Fed will ease policy soon.

Fed funds futures are pricing an implied 80.7% probability of a 25-basis-point cut at the US central bank’s next meeting on December 10, compared to even odds a week ago, according to the CME Group’s FedWatch tool.

Meanwhile, the Pakistani rupee improved further against the US dollar in the inter-bank market on Wednesday. At close, the local currency settled at 280.56, a gain of Re0.01 against the greenback.

Volume on the all-share index increased to 636.41 million from 590.53 million recorded in the previous close. The value of shares rose to Rs30.92 billion from Rs22.15 billion in the previous session.

WorldCall Telecom was the volume leader with 47.78 million shares, followed by Hum Network with 38.12 million shares, and Dost Steels Ltd with 34.68 million shares.

Shares of 474 companies were traded on Wednesday, of which 136 registered an increase, 290 recorded a fall, and 48 remained unchanged.