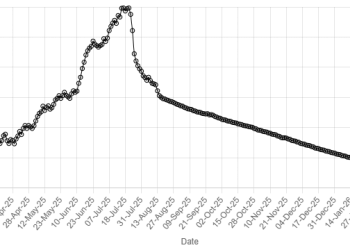

Positive momentum returned to the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining nearly 500 points during intra-day trading on Thursday.

At 12:30pm, the benchmark index was hovering at 114,350.55, an increase of 488.23 points or 0.43%.

Buying was observed in key sectors including automobile assemblers, commercial banks, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks including MCB, MEBL, UBL, MARI, OGDC, PPL, NRL and PRL traded in the green.

In a key development, a mission from the International Monetary Fund (IMF) will arrive in Pakistan next week, Finance Minister Muhammad Aurangzeb said on Wednesday, with a first review of a $7 billion bailout programme due in March.

Islamabad secured the $7 billion Extended Fund Facility (EFF) last summer as part of an economic recovery plan.

The finance minister said that Pakistan’s economy had stabilised and now needs to focus on export-led growth.

On Wednesday, PSX witnessed selling pressure, as its benchmark KSE-100 Index closed the day lower by 666 points to settle at 113,862.33.

Globally, the US dollar firmed in early Asian hours on Thursday as Treasury yields ticked higher while investors assessed the outlook for tariffs and the economy under President Donald Trump.

Asian stocks were mixed with tech shares around the region getting little steer from heavyweight US chipmaker and AI darling Nvidia’s earnings overnight.

Cryptocurrency bitcoin languished below $85,000, while safe-haven gold was steady some $40 below its record high as trade war worries kept market sentiment fragile.

On Wednesday, Trump clouded the outlook for looming levies on top trading partners Canada and Mexico by signalling they would take effect on April 2 – another month-long extension.

However, a White House official later said the previous March 2 deadline for the levies remained in effect “as of this moment”, stirring further uncertainty about US trade policy.

US two-year Treasury yields rose to 4.09%, finding their footing following a slump to the lowest since November 1 at 4.065% in the prior session. The 10-year yield rose to 4.2772% from a low of 4.245% on Wednesday, a 2-1/2-month trough.

This is an intra-day update

Positive momentum returned to the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining nearly 500 points during intra-day trading on Thursday.

At 12:30pm, the benchmark index was hovering at 114,350.55, an increase of 488.23 points or 0.43%.

Buying was observed in key sectors including automobile assemblers, commercial banks, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks including MCB, MEBL, UBL, MARI, OGDC, PPL, NRL and PRL traded in the green.

In a key development, a mission from the International Monetary Fund (IMF) will arrive in Pakistan next week, Finance Minister Muhammad Aurangzeb said on Wednesday, with a first review of a $7 billion bailout programme due in March.

Islamabad secured the $7 billion Extended Fund Facility (EFF) last summer as part of an economic recovery plan.

The finance minister said that Pakistan’s economy had stabilised and now needs to focus on export-led growth.

On Wednesday, PSX witnessed selling pressure, as its benchmark KSE-100 Index closed the day lower by 666 points to settle at 113,862.33.

Globally, the US dollar firmed in early Asian hours on Thursday as Treasury yields ticked higher while investors assessed the outlook for tariffs and the economy under President Donald Trump.

Asian stocks were mixed with tech shares around the region getting little steer from heavyweight US chipmaker and AI darling Nvidia’s earnings overnight.

Cryptocurrency bitcoin languished below $85,000, while safe-haven gold was steady some $40 below its record high as trade war worries kept market sentiment fragile.

On Wednesday, Trump clouded the outlook for looming levies on top trading partners Canada and Mexico by signalling they would take effect on April 2 – another month-long extension.

However, a White House official later said the previous March 2 deadline for the levies remained in effect “as of this moment”, stirring further uncertainty about US trade policy.

US two-year Treasury yields rose to 4.09%, finding their footing following a slump to the lowest since November 1 at 4.065% in the prior session. The 10-year yield rose to 4.2772% from a low of 4.245% on Wednesday, a 2-1/2-month trough.

This is an intra-day update