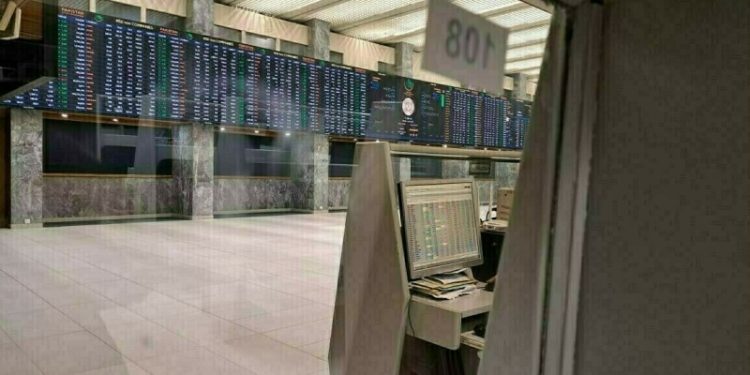

Buying returned to the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining over 1,100 points during the opening hours of trading on Thursday.

At 9:40am, the benchmark index was hovering at 121,629.44 level, an increase of 1163.51 points or 0.97%.

Buying was observed in key sectors including automobile assemblers, cement, commercial banks, fertilizer, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks including HUBCO, PSO, WAFI, MARI, OGDC, PPL, MCB, MEBL, NBP and UBL traded in the green.

United States President Donald Trump on Wednesday said that he was “honoured” to meet Field Marshal Syed Asim Munir for talks at the White House — also marking the first time a US president has hosted army chief at the White House unaccompanied by senior civilian officials.

The lunch is being seen in Islamabad as a major diplomatic win, particularly because earlier this month, an Indian delegation met US Vice President JD Vance and Indian media depicted it as a diplomatic success, contrasting it with the apparent inability of the Pakistani delegation to secure a similar meeting.

On Wednesday, bearish sentiments prevailed at the PSX, with the benchmark KSE-100 Index settling at 120,465.93, amid a loss of 1,505.11 points.

Internationally, stock markets in Asia edged lower on Thursday while safe havens such as gold and the Japanese yen gained as investors remained on edge over the possible entry of the United States into the week-old Israel-Iran air war.

President Donald Trump kept the world guessing about whether the United States will join Israel’s bombardment of Iranian nuclear sites, telling reporters outside the White House on Thursday, “I may do it. I may not do it.”

The Wall Street Journal said Trump had told senior aides he approved attack plans on Iran but was holding off on giving the final order to see if Tehran would abandon its nuclear programme.

Japan’s Nikkei sank 0.8%, with additional downward pressure stemming from a stronger yen, which reduces the value of overseas revenues for the country’s heavyweight exporters.

Taiwan’s stock benchmark slid 0.9%, and Hong Kong’s Hang Seng declined 0.8%.

US S&P 500 futures pointed 0.4% lower, although most US markets – including Wall Street and the Treasury market – are closed on Thursday for a national holiday.

Brent crude edged down to $76.32 per barrel, but remained not far from the 4-1/2-month peak of $78.50 reached on Friday.

The yen gained 0.2% to 144.92 per dollar, while the US currency itself was also in demand as a haven, gaining 0.1% to $1.1472 per euro and 0.2% to $1.3398 versus sterling.

This is an intra-day update

Buying returned to the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining over 1,100 points during the opening hours of trading on Thursday.

At 9:40am, the benchmark index was hovering at 121,629.44 level, an increase of 1163.51 points or 0.97%.

Buying was observed in key sectors including automobile assemblers, cement, commercial banks, fertilizer, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks including HUBCO, PSO, WAFI, MARI, OGDC, PPL, MCB, MEBL, NBP and UBL traded in the green.

United States President Donald Trump on Wednesday said that he was “honoured” to meet Field Marshal Syed Asim Munir for talks at the White House — also marking the first time a US president has hosted army chief at the White House unaccompanied by senior civilian officials.

The lunch is being seen in Islamabad as a major diplomatic win, particularly because earlier this month, an Indian delegation met US Vice President JD Vance and Indian media depicted it as a diplomatic success, contrasting it with the apparent inability of the Pakistani delegation to secure a similar meeting.

On Wednesday, bearish sentiments prevailed at the PSX, with the benchmark KSE-100 Index settling at 120,465.93, amid a loss of 1,505.11 points.

Internationally, stock markets in Asia edged lower on Thursday while safe havens such as gold and the Japanese yen gained as investors remained on edge over the possible entry of the United States into the week-old Israel-Iran air war.

President Donald Trump kept the world guessing about whether the United States will join Israel’s bombardment of Iranian nuclear sites, telling reporters outside the White House on Thursday, “I may do it. I may not do it.”

The Wall Street Journal said Trump had told senior aides he approved attack plans on Iran but was holding off on giving the final order to see if Tehran would abandon its nuclear programme.

Japan’s Nikkei sank 0.8%, with additional downward pressure stemming from a stronger yen, which reduces the value of overseas revenues for the country’s heavyweight exporters.

Taiwan’s stock benchmark slid 0.9%, and Hong Kong’s Hang Seng declined 0.8%.

US S&P 500 futures pointed 0.4% lower, although most US markets – including Wall Street and the Treasury market – are closed on Thursday for a national holiday.

Brent crude edged down to $76.32 per barrel, but remained not far from the 4-1/2-month peak of $78.50 reached on Friday.

The yen gained 0.2% to 144.92 per dollar, while the US currency itself was also in demand as a haven, gaining 0.1% to $1.1472 per euro and 0.2% to $1.3398 versus sterling.

This is an intra-day update

American Dollar Exchange Rate

American Dollar Exchange Rate