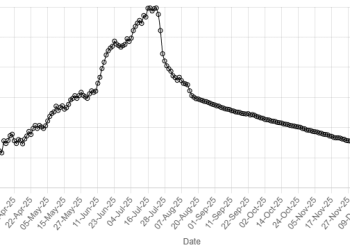

Buying rally continued at the Pakistan Stock Exchange (PSX), amid optimism over government measures to address the crippling circular debt, with the benchmark KSE-100 Index gaining over 800 points during the opening minutes of trading on Thursday.

At 11:55am, the benchmark index was hovering at 159,057.36, a gain of 820.69 points or 0.52%.

Buying momentum was observed in key sectors, including cement, commercial banks, OMCs and power generation. Index-heavy stocks, including HUBCO, KAPCO, POL, PPL, SNGPL, SSGC, HBL, MCB, MEBL and UBL traded in the green.

In a key development revolving the power sector, the government and a consortium of 18 banks have signed Rs1.225 trillion financing facility agreement, a senior government official who attended the ceremony told media.

Meanwhile, Prime Minister Shehbaz Sharif is expected to meet US President Donald Trump at the White House today. The meeting comes weeks after the two countries agreed to a trade deal.

On Wednesday, the PSX closed higher after a volatile session as the KSE 100 index settled at 158,236.68 points, gaining 291.65 points or 0.18%.

Globally, Asian shares took a breather from their recent rally on Thursday as investors positioned for month- and quarter-end flows, while the Japanese yen tested fresh lows against the euro and a surging Swiss franc.

S&P 500 futures and Nasdaq futures inched up 0.1% ahead of a lineup of Federal Reserve officials, whose remarks will be closely watched for their views on interest rates. San Francisco Fed President Mary Daly said further rate cuts will likely be needed but the timing remained unclear.

Fed Chair Jerome Powell had struck a cautious tone about further rate cuts, after the central bank delivered the first easing this year just last week.

MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.2%, having rallied 5.5% for the month and 9% for the quarter. Japan’s Nikkei rose 0.1%, after jumping 7% for the month and 13% for the quarter.

Chinese blue chips were flat, while Hong Kong’s Hang Seng slipped 0.2%.

This is an intra-day update