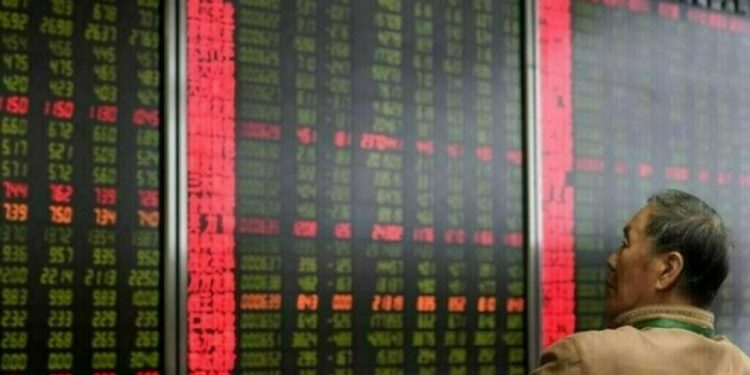

HONG KONG: Chinese and Hong Kong shares fell on Wednesday after the U.S. further restricted Nvidia chip sales to China, raising concerns of an intensifying trade war, which weighed on better-than-expected economic growth data.

China’s blue-chip CSI 300 Index and the Shanghai Composite Index declined 0.9% by the midday break.

The Chinese H-share index listed in Hong Kong, the Hang Seng China Enterprises Index fell 3.1%, while the Hang Seng Index dived 2.5%.

Both China and Hong Kong stocks are set to snap a six-day winning streak.

China’s first-quarter economic growth beat expectations, underpinned by solid consumption and industrial output, even as policymakers brace for the impact of U.S. tariffs that analysts say pose the biggest risk to the Asian powerhouse in decades.

Nvidia said on Tuesday that the U.S. government limited exports of its H20 artificial intelligence chip to China, a key market for one of its most popular chips.

China, HK shares flat as markets await tariff clarity

“The latest tariff headlines — targeting Boeing, critical minerals, and now Nvidia — underscore the deepening strategic decoupling,” said Charu Chanana, chief investment strategist at Saxo.

Reports that the U.S. is using tariff negotiations to push allies to limit China’s economic role added more uncertainties and weighed on sentiment, she said.

Hong Kong-listed tech shares lost more than 4%.

Nvidia supply chain companies Foxconn Industrial Internet and Zhongji Innolight fell 4.8% and 4% respectively.

However, stocks with chip self-sufficiency theme such as Hua Hong Semi and Naura rose more than 1% each.

“The damage from the trade war will show up in the macro data next month,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management, when commenting the first-quarter economic growth data.

“The uncertainty is extremely high for corporates and investors,” he added.

The smaller Shenzhen index was down 2.25%, the start-up board ChiNext Composite index was weaker by 2.47% and Shanghai’s tech-focused STAR50 index was down 0.82%?.

Around the region, MSCI’s Asia ex-Japan stock index was weaker by 1.27% while Japan’s Nikkei index was down 0.92%.

HONG KONG: Chinese and Hong Kong shares fell on Wednesday after the U.S. further restricted Nvidia chip sales to China, raising concerns of an intensifying trade war, which weighed on better-than-expected economic growth data.

China’s blue-chip CSI 300 Index and the Shanghai Composite Index declined 0.9% by the midday break.

The Chinese H-share index listed in Hong Kong, the Hang Seng China Enterprises Index fell 3.1%, while the Hang Seng Index dived 2.5%.

Both China and Hong Kong stocks are set to snap a six-day winning streak.

China’s first-quarter economic growth beat expectations, underpinned by solid consumption and industrial output, even as policymakers brace for the impact of U.S. tariffs that analysts say pose the biggest risk to the Asian powerhouse in decades.

Nvidia said on Tuesday that the U.S. government limited exports of its H20 artificial intelligence chip to China, a key market for one of its most popular chips.

China, HK shares flat as markets await tariff clarity

“The latest tariff headlines — targeting Boeing, critical minerals, and now Nvidia — underscore the deepening strategic decoupling,” said Charu Chanana, chief investment strategist at Saxo.

Reports that the U.S. is using tariff negotiations to push allies to limit China’s economic role added more uncertainties and weighed on sentiment, she said.

Hong Kong-listed tech shares lost more than 4%.

Nvidia supply chain companies Foxconn Industrial Internet and Zhongji Innolight fell 4.8% and 4% respectively.

However, stocks with chip self-sufficiency theme such as Hua Hong Semi and Naura rose more than 1% each.

“The damage from the trade war will show up in the macro data next month,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management, when commenting the first-quarter economic growth data.

“The uncertainty is extremely high for corporates and investors,” he added.

The smaller Shenzhen index was down 2.25%, the start-up board ChiNext Composite index was weaker by 2.47% and Shanghai’s tech-focused STAR50 index was down 0.82%?.

Around the region, MSCI’s Asia ex-Japan stock index was weaker by 1.27% while Japan’s Nikkei index was down 0.92%.