SHANGHAI: China stocks rose on Friday and are set to post their biggest monthly jump since September 2024, as abundant liquidity continues to drive the rally despite warnings from tech firms following recent price surges. Hong Kong shares are on track to log losses for the week.

China’s blue-chip CSI300 Index climbed 0.6% by the lunch break, while the Shanghai Composite Index edged up 0.2%. Hong Kong benchmark Hang Seng rose 0.6%.

For the month, the CSI300 Index is up nearly 10%. The Hang Seng Index is down 0.7% this week and has risen 1% in August.

China’s recent market rally has been underpinned by abundant liquidity in a low-yield environment, alongside government efforts to curb aggressive price competition to boost inflation.

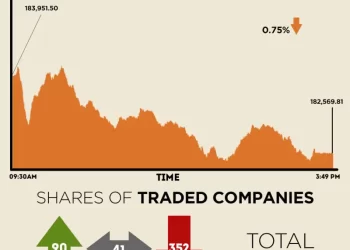

The daily turnover in onshore Chinese shares hovered around 3 trillion yuan ($419.41 billion) this week, with the total turnover for August set to hit a record high.

China’s top economic planner will work with other departments to investigate and punish below-cost dumping, false propaganda and speed regulation of “disorderly competition” in some industries, its spokesperson, Li Chao, said on Friday.

Chinese chip firm Cambricon Technologies on Thursday issued a risk alert to investors in a stock exchange filing, citing a sharp rise in its stock prices since late July. Its shares fell 5.6% on Friday, after they more than doubled this month.

Trading in the shares of China’s Dosilicon was suspended on Friday after the semiconductor maker flagged multiple instances of abnormal stock price volatility since July 29.

The tech-heavy STAR50 index slid 2.5% after surging nearly 30% this month, while consumer staples gained almost 2%, leading onshore advances as investors rotated into defensives.

Tech majors trading in Hong Kong rose 0.6%.