HONG KONG: Chinese stocks edged up in choppy trading on Monday as soft economic data and regulatory moves last week to cool the market rally kept sentiment muted.

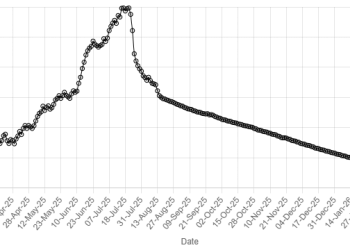

The benchmark Shanghai Composite Index closed 0.3% higher at 4,114, recovering some ground following a four-day losing streak.

The blue-chip CSI300 Index edged up less than 0.1% after swinging between gains and losses during the day.

Fresh data released on Monday showed China’s economic growth slowed to a three-year low of 4.5% last quarter as domestic demand softened. GDP growth, however, showed resilience in 2025 overall, with the full-year pace meeting the official target.

The data came after China’s central bank last week cut sector-specific interest rates, while keeping the door open for further reductions in banks’ cash reserve requirements and broader rate cuts in an early effort to boost demand.

“Today’s economic data really wasn’t a positive surprise,” said Dickie Wong, head of research at uSmart Securities in Hong Kong. “But since the PBOC had already made it clear that there’s still room for RRR cuts, they’re basically giving everyone reassurance. We’ll just have to see what they do going forward.”

The relatively steady start to the week follows last week’s declines, which snapped a start-of-the-year bull run after Beijing moved to cool sentiment.

China’s securities regulator vowed on Friday to step up market monitoring and crack down on excessive speculation, after major bourses said that they would raise the minimum margin requirement for new borrowings to 100% from 80%.

Market consensus now is that Beijing wants to focus on supporting the real economy and consumption as geopolitical uncertainties remain, while taking some heat off frothy sectors to cool market sentiment before it gets out of hand, Wong said.

“Locals are expecting further normalization this week across China A-shares” following the record trading volume of key benchmark ETFs, along with incremental guidance from regulators for a slow and long bull market, analysts at Goldman Sachs wrote in a note.

Among major winners on Monday, the defence sector climbed 3.6% and satellite industry added 2.6%. The real estate index gained 1.5%.

The AI sector weakened 1.3% while the banking sector declined 0.6%, weighing on the broader market.

In Hong Kong, the benchmark Hang Seng index lost 1.1% to 26,563.90. The Hang Seng Tech Index fell 1.2%.