SHANGHAI: China’s yuan climbed past the psychologically important 6.90 per dollar mark for the first time in 33 months on Thursday, buoyed by heavy corporate demand for the currency before the Lunar New Year and firmer sentiment toward Chinese assets.

The onshore yuan rose to 6.8998 per dollar and its offshore counterpart to 6.8966, their strongest since May 4, 2023.

Companies, particularly exporters, typically need yuan ahead of the long Lunar New Year holiday to meet various obligations such as employee wages, supplier payments and bonuses.

The week-long holiday runs from February 15 to 23 this year.

Market participants said 6.90 is a pivotal level, with a cluster of options strikes likely around that mark.

The yuan also drew support from improved sentiment towards both onshore equity and bond markets.

The benchmark CSI300 index was up more than 20% over the past year, while the 10-year sovereign bond futures hovered near their highest in 3 months.

The spot yuan opened at 6.9083 per dollar and was last trading at 6.9022 as of 0203 GMT, 84 pips firmer than the previous late session close.

In the near term, seasonal dollar-to-yuan conversions after the Lunar New Year may fade, bringing supply and demand toward balance and shifting the rate back to fundamentals, analysts at China Construction Bank said in a note.

They said markets should watch the balance between appreciation expectations and policies to steady the currency, and expect two-way moves within 6.85–6.99 per dollar.

The yield gap between benchmark 10-year US Treasuries and their Chinese counterpart shrank to about 238 basis points on Thursday, down from a peak of 315 basis points earlier last year.

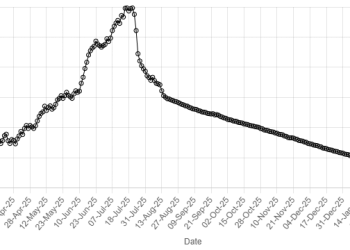

Meanwhile, the yuan has strengthened 1.3% against the dollar so far this year, after booking a 4.5% gain last year, which was the best annual performance since 2020.

Prior to the market opening, the People’s Bank of China set the midpoint rate at 6.9457 per dollar, 304 pips weaker than a Reuters’ estimate. The spot yuan is allowed to trade 2% either side of the fixed midpoint each day.

The offshore yuan traded at 6.8987 yuan per dollar, up about 0.17% in Asian trade.

The dollar index, which measures the greenback against a basket of six currencies, was 0.127% lower at 96.79.

American Dollar Exchange Rate

American Dollar Exchange Rate