HONG KONG: China’s yuan firmed against the US dollar on Friday after the central bank vowed to keep the yuan exchange rate stable amid rising external challenges.

The yuan and other emerging market currencies also got some relief after US President Donald Trump’s threatened reciprocal tariffs were not immediately imposed.

Spot yuan opened at 7.2750 per dollar and was last trading 57 pips firmer than the previous late session close and 1.58% weaker than the midpoint.

The yuan is down 0.1% this week and has dropped 0.4% against the dollar so far this month.

The People’s Bank of China said late on Thursday that it would keep the yuan exchange rate basically stable at a “reasonable and balanced” level and reiterated it would prevent overshooting risks.

Yuan rebounds from 3-week low

Prior to the market opening, the People’s Bank of China set the midpoint rate, around which the yuan is allowed to trade in a 2% band, at 7.1706 per dollar, its strongest since February 7 and 1,033 pips firmer than a Reuters’ estimate.

The yuan has rebounded in the past few days, supported by optimism in stock markets and hopes for a de-escalation in tensions between the US and China on headlines that China proposed to hold a summit between Russian President Vladimir Putin and US President Donald Trump to help end the Ukraine war.

Overnight US producer price data pointing to lower inflation and the delay in Trump’s plan for reciprocal tariffs also sent the dollar lower and eased pressure on Asian currencies, MayBank analysts said in a note.

“Combined with strong language on FX management, this suggests that the PBOC is currently prioritizing financial stability over immediate monetary policy easing,” Goldman Sachs economists said, while adding they are maintaining their forecast of 50-basis point reserve requirement cuts in both the first quarter and third quarter, and 20-bps policy rate cuts in both the second quarter and fourth quarter.

The offshore yuan traded at 7.2839 yuan per dollar, down about 0.17% in Asian trade.

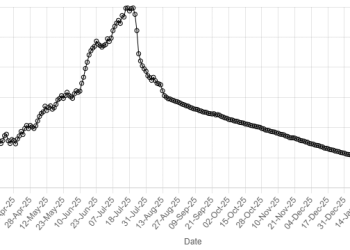

American Dollar Exchange Rate

American Dollar Exchange Rate