Australian shares declined on Friday, dragged down by commodity and healthcare stocks, while hearing-implants maker Cochlear tumbled as much as 16% on a weak annual forecast and weaker-than-expected first-half earnings.

The S&P/ASX 200 index fell 0.8% to 8,975.80 points by 2318 GMT.

The benchmark, which has gained 2% this week, is on course for its best week since April 2025.

It ended 0.3% higher on Thursday, its highest close since late October.

Cochlear, one of Australia’s priciest stocks, was

headed for its worst session since mid-March 2020 after flagging full-year earnings toward the low end of its forecast following a weaker-than-expected first half.

Stock was among the top drags on the benchmark as well as on the healthcare sub-index which fell 1.7%.

The sub-index fell to its lowest level since late April 2019.

Westpac rose as much as 2.8% to a record high level after the banker reported a 6% rise in its first-quarter underlying profit, and was among the top gainers on the financials sub-index, which was up 0.3%.

Three of the “Big Four” banks rallied after delivering strong results, helping the sub-index gain 5.8% this week and put it on course for its best week since early March 2022.

Investors are now pivoting their focus to National Australia Bank, which is slated to report earnings on Wednesday.

Among sub-indexes, miners snapped their four-day winning streak, to fall 2.3% as iron ore and copper traded on weaker prices.

Top miners BHP Group, Rio Tinto and Fortescue fell between 0.8% and 1.3%.

BHP and Rio Tinto will report their earnings next week.

Gold stocks declined as much as 4.9%, snapping a four-day rally as bullion fell.

Energy stocks fell as much as 1.6% on weak oil prices.

In New Zealand, the benchmark S&P/NZX 50 index fell 0.8% to 13,421.88.

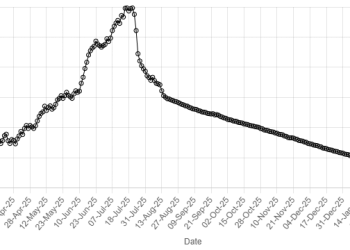

American Dollar Exchange Rate

American Dollar Exchange Rate