The Association of Builders and Developers of Pakistan (ABAD) has called for a long-term 15-year tax policy for the construction sector, stating that frequent changes in tax laws create uncertainty in the market.

The association on Thursday submitted its proposals to the federal government for the upcoming budget for the fiscal year 2025-26, emphasising tax system reforms, transparency, and the promotion of investment.

In the proposals, ABAD chairman Muhammad Hassan Bakshi called for a long-term 15-year tax policy to restore investor confidence.

“Frequent changes in tax laws create uncertainty in the market,” he said.

The association also called for the abolition of advance tax under Section 236C and the limitation of the maximum tax rate under Section 236K to 0.5%.

Eliminating FED alone won’t revive Pakistan’s real estate, says ABAD chairman

Eliminating the advance tax would make property transfers easier and faster, reduce the financial burden on buyers and investors, while enhancing transparency in transactions, according to Bakshi.

ABAD chairman also demanded the abolition of Section 7E and Section 7F, arguing that under Section 7E, a 1% tax is imposed on individuals who own property but do not generate income from it, which the association termed “unfair”.

It also suggested replacing the current complex system under Section 7F with a simplified per-square-foot tax system, similar to the one in Sections 7C and 7D, to ensure transparency and ease.

Regarding Capital Gains Tax, ABAD chairman said that the current system for capital gains tax on property sales was unclear.

The association wants the tax to be based on how long the property has been held, which it believes will create balance and predictability in the market. Its budget proposals also claimed that the approval process for refunds by the Federal Board of Revenue (FBR) “is slow and opaque”.

ABAD chairman emphasised that removing such requirement would allow the business community to receive immediate relief.

Bakshi maintained that there were inconsistencies in the valuation tables used for determining property prices, which he believes cause issues in transactions.

“Addressing the inconsistencies would make a fairer and more transparent tax system possible. ABAD’s proposals also include recommending a reduction in the withholding tax rate.”

He suggested lowering the withholding tax rate to increase property transactions and government revenue.

Improving tax-to-GDP ratio crucial to ease Pakistan debt burden: FBR official

Bakshi proposed that the government ease tax policies for overseas Pakistanis to boost remittances.

“When overseas Pakistanis purchase property in the country using dollars, they are subjected to a transfer tax, which ABAD considers unfair.”

Eliminating the policy would increase remittances and restore the confidence of overseas investors, he said.

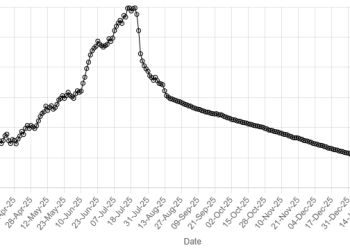

American Dollar Exchange Rate

American Dollar Exchange Rate