Copper and nickel are poised to end the week higher on Friday, despite a recent selloff as investors booked profits following a rally.

The most-active copper contract on the Shanghai Futures Exchange declined 0.98% to 100,870 yuan ($14,452.74) a metric ton as of 0315 GMT, and was poised to end the week up 2.13%.

The benchmark three-month copper on the London Metal Exchange, however, rose 0.69% to $12,808 a ton, set for a 2.64% weekly gain.

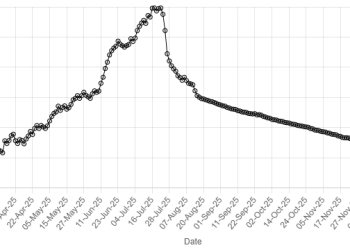

Earlier this week, the Shanghai copper set a record at 105,500 yuan a ton, while the London copper peaked at $13,386.50.

Copper’s pullback since Wednesday was largely driven by profit-taking, while the red metal remained well-supported by supply concerns stemming from mine disruptions and tight refined copper availability outside the US amid tariff uncertainties.

Elsewhere in the market, global miners are exploring ways to bolster their exposure to metals like copper, which is set to benefit from the energy transition and electrification.

Glencore and Rio Tinto reopened early merger talks that could potentially create the world’s largest mining company.

This follows Anglo American and Teck Resources’ nearly finalised merger to make a copper heavyweight.

Meanwhile, Shanghai’s most-traded nickel tumbled 3.83% to 137,430 yuan a ton, and was set to end the week rising 2.78%.

It touched its highest since June 2024 at 149,600 yuan a ton earlier this week.

The London benchmark nickel rose 0.82% to $17,295 a ton, set to post a 2.53% weekly gain after marking its highest

since June 2024 at $18,800 a ton.

It narrowed the loss from Thursday’s selloff after Indonesia’s mining ministry did not provide further details on its plan to slash nickel mining quotas in 2026.

The mining minister reiterated in a press briefing on Thursday that the quotas would be adjusted to meet demand by local smelters.

Among other SHFE base metals, aluminium rose 1.23%, zinc dropped 0.33%, lead declined 1.14% and tin was flat.

Elsewhere among LME metals, aluminium rose 1.04%, zinc added 0.72%, lead gained 0.52% and tin climbed 1.73%.