LONDON: Copper prices held in positive territory on Friday after China pledged more support for its ailing economy, though gains were capped by uncertainty surrounding the threat of U.S. tariffs on the world’s biggest metal consumer.

Three-month copper on the London Metal Exchange (LME) was up 0.2% at $8,817.50 a metric ton by 1015 GMT, holding above the $8,757 five-month low touched on Tuesday.

China will sharply increase funding from ultra-long treasury bonds in 2025 to spur business investment and consumer-boosting initiatives, a state planning official said on Friday.

“The Chinese news is keeping our head above water, but we’re facing an interesting year with the tariffs and the market trying to work out what kind of impact they may have on prices,” said Ole Hansen, head of commodity strategy at Saxo Bank in Copenhagen.

U.S. President-elect Donald Trump has vowed to impose tariffs of 10% on global imports into America, along with a 60% tariff on Chinese goods.

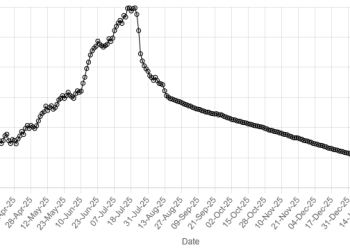

Copper eases but heads for second straight yearly rise

The potential tariffs and disappointment about the level of stimulus Beijing has provided to boost flagging economic growth has weighed on copper prices, which have slid 13% since hitting a four-month peak of $10,158 on Sept. 30.

The most traded January copper contract on the Shanghai Futures Exchange dropped 0.5% on Friday to 72,920 yuan ($9,989.31) a ton.

Most other LME metals were in the red after the dollar index jumped to a two-year high on Thursday, fuelled by expectations of only slow reductions to U.S. interest rates after a larger than expected drop in weekly jobless claims.

The dollar eased slightly on Friday but was poised for its strongest weekly performance in more than a month.

A stronger U.S. currency makes it more expensive for holders of other currencies to buy dollar-priced commodities.

Among other metals, LME aluminium fell 0.9% to $2,505.50 a ton, nickel eased 0.6% to $14,990, zinc dropped 1.4% to $2,887.50, lead was 0.6% down at $1,923.50 and tin rose 0.1% to $28,590.

American Dollar Exchange Rate

American Dollar Exchange Rate