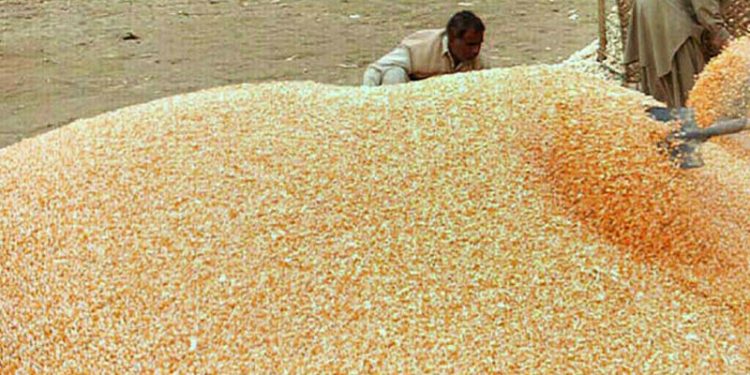

PARIS/SINGAPORE: Chicago corn futures slipped to a new three-week low on Friday on expectations of increased U.S. planting this year, while wheat hit a seven-month low as traders focused on sluggish exports and rain relief in parts of the U.S. Plains.

Soybeans also fell, with a day-earlier rally in byproduct soyoil petering out.

Like other commodities, grain markets were subdued before broad tariffs promised by U.S. President Donald Trump from April 2, as well as proposed U.S. port fees on Chinese-built vessels.

“Agri markets are trading cautiously ahead of April 2 tariff announcements, alongside the USDA’s March 31 reports,” JPMorgan analysts said.

The U.S. Department of Agriculture’s planting report will be issued together with quarterly estimates of U.S. grain stocks in one of the most closely watched data releases of the year for grain markets.

U.S. farmers will plant 94.361 million acres with corn this year, up from 90.594 million in 2024, according to an average of analysts polled by Reuters before the USDA publication.

Expectations of a jump in U.S. corn acres have pressured prices, taking attention away from dry crop conditions in parts of Brazil.

Corn prices struggle on US planting outlook, soybeans firm

The most-active corn contract on the Chicago Board of Trade was down 1.0% at $4.45-1/2 a bushel by 1256 GMT, after earlier reaching its lowest since March 4 at $4.45-1/2.

CBOT wheat was down 1.5% at $5.24 a bushel. It earlier touched its lowest level since August 27 at $5.22-1/2 to go below a two-month low hit on Thursday.

Forecast rain for U.S. and Russian wheat belts and a low volume of U.S. wheat export sales reported on Thursday have helped push wheat futures lower.

U.S. plans to levy steep port fees on vessels with links to China were creating uncertainty over exports, traders said.

“U.S. wheat looks competitive in places like Africa but the freight issue means it’s not being booked,” a European trader said.

A U.S.-backed deal this week aimed at a ceasefire in the Black Sea has also weighed on wheat markets by raising the prospect of smoother exports from Russia and Ukraine.

CBOT soybeans gave up 0.5% to $10.11-1/2 a bushel.

Brazil’s farmers are expected to reap a record 172.1 million metric tons of soybeans in the 2024/2025 season, consultancy Agroconsult forecast on Thursday, putting attention back on a bumper crop in the top soybean exporter.

Soybean futures had risen on Thursday on the back of a jump in soyoil, buoyed in turn by a Reuters report that the Trump administration has asked oil and biofuels producers to reach a deal on the next phase of U.S. biofuel policy.

PARIS/SINGAPORE: Chicago corn futures slipped to a new three-week low on Friday on expectations of increased U.S. planting this year, while wheat hit a seven-month low as traders focused on sluggish exports and rain relief in parts of the U.S. Plains.

Soybeans also fell, with a day-earlier rally in byproduct soyoil petering out.

Like other commodities, grain markets were subdued before broad tariffs promised by U.S. President Donald Trump from April 2, as well as proposed U.S. port fees on Chinese-built vessels.

“Agri markets are trading cautiously ahead of April 2 tariff announcements, alongside the USDA’s March 31 reports,” JPMorgan analysts said.

The U.S. Department of Agriculture’s planting report will be issued together with quarterly estimates of U.S. grain stocks in one of the most closely watched data releases of the year for grain markets.

U.S. farmers will plant 94.361 million acres with corn this year, up from 90.594 million in 2024, according to an average of analysts polled by Reuters before the USDA publication.

Expectations of a jump in U.S. corn acres have pressured prices, taking attention away from dry crop conditions in parts of Brazil.

Corn prices struggle on US planting outlook, soybeans firm

The most-active corn contract on the Chicago Board of Trade was down 1.0% at $4.45-1/2 a bushel by 1256 GMT, after earlier reaching its lowest since March 4 at $4.45-1/2.

CBOT wheat was down 1.5% at $5.24 a bushel. It earlier touched its lowest level since August 27 at $5.22-1/2 to go below a two-month low hit on Thursday.

Forecast rain for U.S. and Russian wheat belts and a low volume of U.S. wheat export sales reported on Thursday have helped push wheat futures lower.

U.S. plans to levy steep port fees on vessels with links to China were creating uncertainty over exports, traders said.

“U.S. wheat looks competitive in places like Africa but the freight issue means it’s not being booked,” a European trader said.

A U.S.-backed deal this week aimed at a ceasefire in the Black Sea has also weighed on wheat markets by raising the prospect of smoother exports from Russia and Ukraine.

CBOT soybeans gave up 0.5% to $10.11-1/2 a bushel.

Brazil’s farmers are expected to reap a record 172.1 million metric tons of soybeans in the 2024/2025 season, consultancy Agroconsult forecast on Thursday, putting attention back on a bumper crop in the top soybean exporter.

Soybean futures had risen on Thursday on the back of a jump in soyoil, buoyed in turn by a Reuters report that the Trump administration has asked oil and biofuels producers to reach a deal on the next phase of U.S. biofuel policy.

American Dollar Exchange Rate

American Dollar Exchange Rate