KARACHI: Chief Secretary Sindh Asif Hyder Shah has proposed introducing an option for taxpayers to pay motor vehicle taxes in advance for three to five years, offering a convenient solution for those wishing to settle their obligations for the upcoming years at once.

This initiative aims to provide taxpayers with greater flexibility in managing their payment.

He directed the Excise, Taxation, and Narcotics Control Department to make the Motor Vehicle Tax process more user-friendly by leveraging technology and minimizing human involvement. He emphasized that these reforms are essential to ensure greater efficiency, transparency, and public convenience in the tax collection process.

The Chief Secretary highlighted the importance of adopting modern technology to make the process smoother for the people and to reduce manual intervention, which will ultimately enhance the experience for taxpayers.

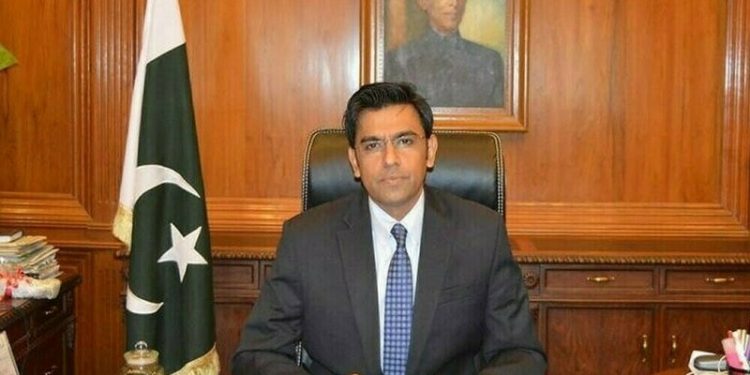

Chairing a high-level meeting to review the department’s development initiatives, the Chief Secretary also instructed the department to broaden its tax base to optimize revenue collection.

The meeting was attended by the Secretary Excise, Taxation and Narcotics Department Muhammad Saleem Rajput, Secretary Implementation & Coordination Shahab Qamar Ansari and other senior officers.

During the meeting the department reported significant achievements in revenue collection for the financial year 2024-25. As of November 2024, Rs. 6,532 million had been collected under Motor Vehicle Tax. Additionally, Rs. 707million were collected through Professional Tax, and Rs. 85,172 million through Infrastructure Cess. The department also collected Rs. 49 million through Entertainment Duty, Rs 3756 in Excise Enactment Tax and Rs. 71 million from Cotton Fee. The department also highlighted its ongoing development projects under the Annual Development Program (ADP), which includes six infrastructure projects and one IT initiative. These projects are aimed at enhancing the department’s operational efficiency and improving the delivery of public services.

As part of its ongoing modernization efforts, the department has introduced several innovative initiatives, including biometric verification for motor vehicle registration, cashless transactions, and the online auctioning of premium vehicle number plates. These measures reflect the department’s commitment to improving governance and enhancing transparency. Additionally, amendments to the Motor Vehicle Ordinance (1965) and revisions in tax rates for the 2024-25 budget were discussed as part of the ongoing efforts to align the department with modern standards and streamline its operations.

The meeting also focused on the department’s efforts under the Sindh Control of Narcotics Substances Act, 2024.

The Chief Secretary was briefed on the progress made in combating narcotics-related issues. Furthermore, the department shared that in 2024, 114 narcotics-related cases were registered, and 142 individuals were also arrested. To enhance the department’s capacity to tackle narcotics-related challenges, the Chief Secretary approved Rs. 40 million for the procurement of modern equipment for narcotics control operations. This funding will significantly improve the department’s ability to combat the growing issue of narcotics in the region.

Asif Hyder Shah commended the department for its ongoing efforts and emphasized the importance of continued innovation and public facilitation in achieving its objectives. He reiterated the Sindh government’s commitment to supporting the Excise, Taxation, and Narcotics Control Department in its efforts to modernize, improve public service delivery, and ensure a transparent, efficient, and secure environment for the people of Sindh.

KARACHI: Chief Secretary Sindh Asif Hyder Shah has proposed introducing an option for taxpayers to pay motor vehicle taxes in advance for three to five years, offering a convenient solution for those wishing to settle their obligations for the upcoming years at once.

This initiative aims to provide taxpayers with greater flexibility in managing their payment.

He directed the Excise, Taxation, and Narcotics Control Department to make the Motor Vehicle Tax process more user-friendly by leveraging technology and minimizing human involvement. He emphasized that these reforms are essential to ensure greater efficiency, transparency, and public convenience in the tax collection process.

The Chief Secretary highlighted the importance of adopting modern technology to make the process smoother for the people and to reduce manual intervention, which will ultimately enhance the experience for taxpayers.

Chairing a high-level meeting to review the department’s development initiatives, the Chief Secretary also instructed the department to broaden its tax base to optimize revenue collection.

The meeting was attended by the Secretary Excise, Taxation and Narcotics Department Muhammad Saleem Rajput, Secretary Implementation & Coordination Shahab Qamar Ansari and other senior officers.

During the meeting the department reported significant achievements in revenue collection for the financial year 2024-25. As of November 2024, Rs. 6,532 million had been collected under Motor Vehicle Tax. Additionally, Rs. 707million were collected through Professional Tax, and Rs. 85,172 million through Infrastructure Cess. The department also collected Rs. 49 million through Entertainment Duty, Rs 3756 in Excise Enactment Tax and Rs. 71 million from Cotton Fee. The department also highlighted its ongoing development projects under the Annual Development Program (ADP), which includes six infrastructure projects and one IT initiative. These projects are aimed at enhancing the department’s operational efficiency and improving the delivery of public services.

As part of its ongoing modernization efforts, the department has introduced several innovative initiatives, including biometric verification for motor vehicle registration, cashless transactions, and the online auctioning of premium vehicle number plates. These measures reflect the department’s commitment to improving governance and enhancing transparency. Additionally, amendments to the Motor Vehicle Ordinance (1965) and revisions in tax rates for the 2024-25 budget were discussed as part of the ongoing efforts to align the department with modern standards and streamline its operations.

The meeting also focused on the department’s efforts under the Sindh Control of Narcotics Substances Act, 2024.

The Chief Secretary was briefed on the progress made in combating narcotics-related issues. Furthermore, the department shared that in 2024, 114 narcotics-related cases were registered, and 142 individuals were also arrested. To enhance the department’s capacity to tackle narcotics-related challenges, the Chief Secretary approved Rs. 40 million for the procurement of modern equipment for narcotics control operations. This funding will significantly improve the department’s ability to combat the growing issue of narcotics in the region.

Asif Hyder Shah commended the department for its ongoing efforts and emphasized the importance of continued innovation and public facilitation in achieving its objectives. He reiterated the Sindh government’s commitment to supporting the Excise, Taxation, and Narcotics Control Department in its efforts to modernize, improve public service delivery, and ensure a transparent, efficient, and secure environment for the people of Sindh.