SINGAPORE: The US dollar was perched at an over two-month high against major currencies on Tuesday, spurred by wagers the Federal Reserve will proceed with modest rate cuts in the near term, while the yen inched closer to the key 150 per dollar level.

The euro was steady in early Asian hours but close to its lowest level since Aug. 8 that it touched on Monday ahead of the European Central Bank policy meeting on Thursday, where the central bank looks set to deliver another interest rate cut.

A string of US data has shown the economy to be resilient and slowing only modestly, while inflation in September rose slightly more than expected, leading traders to trim bets on large rate cuts from the Fed.

The US central bank kicked off its easing cycle with an aggressive 50 basis points at its last policy meeting in September. Traders are now ascribing 89% chance of a 25 bps cut in November, with 45 bps of easing priced in for the year.

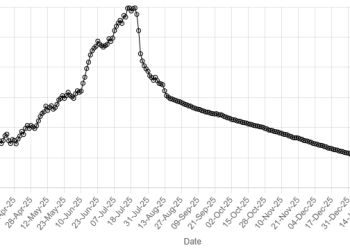

The dollar index, which measures the US currency against six rivals, was last at 103.18, just shy of 103.36, the highest level since Aug. 8 it touched on Monday.

The index is up 2.5% and on course to snap its three-month losing streak.

The dollar got a lift after Fed Governor Christopher Waller on Monday called for “more caution” on interest rate cuts ahead, citing recent economic data.

“Whatever happens in the near term, my baseline still calls for reducing the policy rate gradually over the next year,” Waller said. Recent hurricanes and a strike at Boeing could make job market readings difficult, stripping perhaps more than 100,000 from monthly job gains in October, Waller estimated.

The next non-farm payrolls (NFP) data is due in early November.

Dollar flat against peers

“Most knew that recent disruptions would result in the NFP print being a messy affair, but Waller’s comment goes some way in quantifying the sort of disruption we can expect,” said Chris Weston, head of research at Pepperstone.

“Essentially, with the next NFP so distorted, the market won’t have the same level of control in pricing risk into the November FOMC meeting.”

The dollar’s rise in the past few weeks has pushed the yen lower, especially after a dovish shift in rhetoric from Bank of Japan Governor Kazuo Ueda and surprising opposition to further rate hikes by new Prime Minister Shigeru Ishiba.

That has cast doubts over when Japan’s central bank will next tighten policy. The yen last fetched 149.55 per dollar in early trading, having touched a 2-1/2 month high of 149.98 on Monday when Japan was closed for a holiday. It last hit the 150 level on Aug. 1.

Meanwhile, the Australian dollar was steady at $0.67275, while the New Zealand dollar was 0.13% lower at $0.6089. The euro last bought $1.090825.

China’s offshore yuan was little changed at 7.0935 per dollar after Caixin Global reported China may raise an additional 6 trillion yuan ($850 billion) from Treasury bonds over three years to help bolster a sagging economy through added fiscal stimulus.

Tony Sycamore, market analyst at IG, said the market now appears to be taking the view that fresh stimulus measures are on the horizon, possibly at the China National People’s Congress standing committee meeting later this month.

American Dollar Exchange Rate

American Dollar Exchange Rate