SINGAPORE: The US dollar regained its footing in early Asian trading on Thursday after the U.S. Supreme Court said it would hear arguments in January over President Donald Trump’s attempt to remove Federal Reserve Governor Lisa Cook, leaving her in the post for now.

Market concern about the Fed’s independence now “moves to the backburner for the next few months,” said Tony Sycamore, market analyst at IG in Sydney.

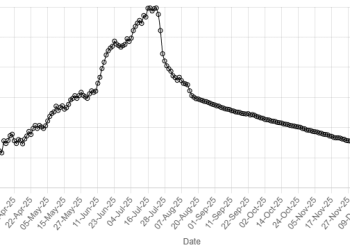

The dollar’s broader index measure against a basket of key currencies edged up 0.1% to 97.80, retracing declines after four straight days of losses, as traders pondered the length of the U.S. government shutdown and its effect on economic data releases.

“We’re in a bit of a void,” Sycamore added. “We’re effectively done now, in terms of market-moving data, until October 13.”

The U.S. government shutdown has put the brakes on the flow of federal economic data at a moment of uncertainty and division among policymakers.

The Trump administration on Wednesday froze $26 billion for Democratic-leaning states, following through on a threat to use the shutdown to target Democratic priorities.

The betting website Polymarket, indicates the highest likelihood that the standoff will last between one or two weeks, though there is currently a 34% probability of a longer shutdown, with just shy of $1 million wagered.

U.S. private payrolls unexpectedly dropped by 32,000 last month after a downwardly revised 3,000 decline in August, according to data released by ADP on Wednesday. Investors have focused on this report for fresh clues on the health of the workforce, as the shutdown means the Labor Department’s more comprehensive and closely followed employment report for September will not be published on Friday.

U.S. manufacturing activity also edged up in September, though new orders and employment were subdued as factories grappled with the fallout from Trump’s sweeping tariffs.

The market is assuming that further policy easing at the Federal Reserve’s October meeting is a lock, with Fed funds futures implying a 99.4% probability of a 25-basis-point cut, up from 96.2% a day earlier, according to the CME Group’s FedWatch tool.

Gold, which has surged to record highs as investors back away from the U.S. dollar, slipped 0.2% in early trading to $3,857.09 per ounce.

Against the yen, the dollar traded at 147.305 yen , up 0.2% from late U.S. levels.

Against the offshore yuan, the dollar fetched 7.13 yuan , up 0.1% in early Asian trade. Chinese markets are closed for the Golden Week holiday.

The euro stood at $1.1725 , down 0.04% so far in Asia, after the Wall Street Journal reported the United States will provide Ukraine with intelligence for long-range missile strikes on Russia’s energy infrastructure.

Sterling was steady at $1.3474.

The Australian dollar was 0.1% weaker at $0.6608 , while the kiwi fetched $0.58145 , little changed in early trading.