Euro zone government bond yields were on track for a weekly decline as the Israel-Iran air war entered its eighth day, with investors downplaying inflation concerns while awaiting clarity on a potential US involvement in the conflict.

President Donald Trump will make a decision in the next two weeks, the White House said on Thursday, raising pressure on Tehran to come to the negotiating table.

German 10-year yields, which serve as the benchmark for the wider euro zone, fell 2.5 basis points (bps) to 2.49%, and were set to end the week 4.5 bps lower. Money markets priced in a European Central Bank deposit facility rate at 1.77% in December, compared with 1.75% last week.

The yield on the German two-year bonds, which are more sensitive to expectations for ECB policy rates, was down 1.5 bps at 1.83%.

Euro zone bond yields steady before Fed, traders await new catalysts

A drop in appetite for risk assets widened yield spreads for government bonds of highly indebted countries, such as Italy and France, against safe-haven German Bunds.

Italy’s 10-year yields dropped 4.5 bps to 3.50%. Italian yield gap against Bunds – a market gauge of the risk premium investors demand to hold Italian debt – tightened to 100 bps on Friday, but was set for its biggest weekly rise in a year.

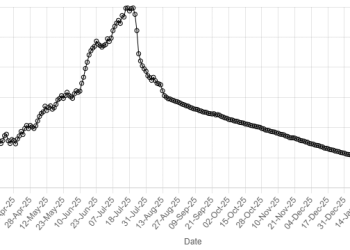

American Dollar Exchange Rate

American Dollar Exchange Rate