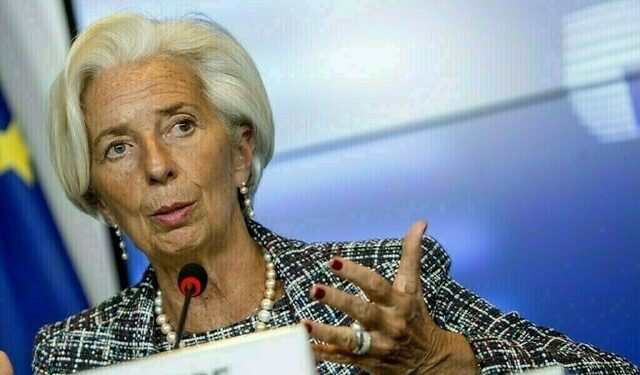

FRANKFURT: Europe needs bigger and stronger banks that can compete with their US and Chinese rivals, European Central Bank President Christine Lagarde said on Monday, just as Italy’s UniCredit was looking to possibly take over Germany’s Commerzbank.

UniCredit, Italy’s number two bank, is pressing for a tie-up between the lenders after snapping up a Commerzbank stake earlier this month, drawing criticism from both the bank and Germany’s political establishment, who want to keep the lender independent.

Lagarde said that scaling up was in Europe’s best interest and it should be private sector players deciding whether to go ahead with deals.

“Cross borders mergers — banks that can actually compete at a scale, at a depth and at range with other institutions around he world, including the American banks and the Chinese banks — are in my opinion desirable,” Lagarde told a Parliamentary hearing.

She added that her comments should not be takes as a direct intervention in any particular deal.

Sources earlier said that ECB policymakers are in support of the deal in principle and viewed Berlin’s opposition as running against the principle of European integration.

Speaking to the European Parliament’s Committee on Economic and Monetary Affairs, Lagarde said that mergers come with some risks but it should be up to the private sector to decide whether a deal makes sense.

“Cross-border mergers, if they produce larger institutions that are more agile, that have more scale, that have more depth, have lots of benefits,” Lagarde said.

“It’s not without liability, without potential risks, but of course it is for the undertakers of those initiatives in the private sector to measure all that and to determine whether it does make sense or not,” she said.

The ECB’s supervision arm will ultimately have to sign off on UniCredit’s plans to raise its Commerzbank stake and the rate setting Governing Council also has to sign off on any merger.