Euro zone government bonds were little changed on Friday after a sell-off last month, with investors focusing on a US jobs report later in the day that could set the tone heading into next week’s Federal Reserve meeting and presidential election.

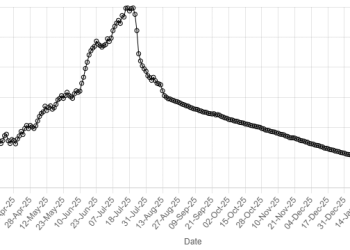

German 10-year bond yield, the benchmark for the euro zone, was little changed at 2.394% after jumping to late-July highs on Thursday and ended October with a 26-basis-point (bps) surge, the steepest jump in six months.

A series of euro zone data this week including stronger-than-expected growth in the third quarter and a faster-than-expected rise in inflation in October bolstered bets that the European Central Bank would not opt for a hefty interest rate cut in December, pushing yields higher.

Germany’s two-year bond yield, which is more sensitive to ECB rate expectations, was little changed at 2.30% after hitting a near two-month high of 2.392% a day earlier.

With little domestic economic data on Friday, eyes will be on US nonfarm payrolls at 1230 GMT, which is likely to show US job growth slowed sharply in October amid disruptions from hurricanes and strikes by factory workers.

However, a steady unemployment rate would offer assurance that the labour market remained on solid footing.

Euro zone yields rise after better than expected data

A strong September employment report was among the initial data that helped drive down expectations that the Fed would need to cut its interest rates aggressively again.

Traders are near certain that the Fed will cut rates by 25 bps on Nov. 7 and see a 70% chance of a similar move in December.

Investors were also on edge ahead of US presidential election next week where Republican presidential candidate Donald Trump and his Democratic rival Kamala Harris face each other in what polls show to be a tight race.

Despite being neck and neck in the polls, investors’ have bet on a Trump victory, fuelling higher Treasury yields.

Trump’s plans on tariffs, taxes and immigration is expected to stoke inflation.

The benchmark US 10-year yields was last at 4.2846%, hovering near four-month highs.

American Dollar Exchange Rate

American Dollar Exchange Rate