The Federal Board of Revenue (FBR) Chairman Rashid Mahmood Langrial on Sunday reaffirmed determination to purchase 1,010 cars for tax officers, saying the decision would help achieve the set tax collection target for the current fiscal year 2024-25.

The development came after the Senate Standing Committee on Finance and Revenue raised objections on the FBR’s decision to purchase new vehicles.

Senator Faisal Vawda called for an immediate halt to the purchase, arguing that the FBR officers were being rewarded with vehicles despite a significant tax shortfall.

“This is open corruption, and we will not sit idly by,” Senator Vawda asserted, accusing the FBR of misusing government funds during the Senate committee meeting earlier this week.

However, on Sunday, FBR chief defended the decision, saying new cars were required for tax officers to go into the fields to collect revenue in taxes.

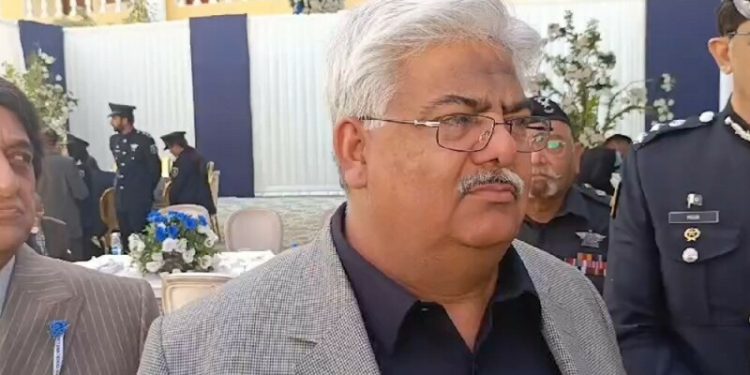

“We will buy the cars. This is the Cabinet decision,” Langrial said while talking to the media on the sidelines of the International Customs Day 2025 organised by the Collector of Customs Enforcement in Karachi.

He claimed that the Senate Standing Committee raised objections on the procedure, but not on purchase of the cars. “We will get the procedure reviewed.”

Langrial further said the reservations and objections raised by the Senate Standing Committee “will be answered clearly and loud…in a humble way and with all due respect”.

He reiterated that the vehicles were required for the officers for field operations.

“They are young people (officers). How would they collect sales tax (without availability of proper transportation)? Sales tax cannot be collected until you do site visits,” Langrial said.

Responding to a question, the FBR chief maintained that the tax collection body would achieve its set target for FY25.

FBR has been tasked to collect Rs12.9 trillion in the current fiscal year.

However, the tax body remained short of Rs386 billion during the first six months (Jul-Dec) of FY25 against the assigned target of Rs6,009 billion for the said period.

Meanwhile, Langrial apprised that the FBR received bids to reinstall the live tracking system on both – vehicles transporting containers and on containers as well – to make the goods transportation system strengthened, transparent, and more secure.

The vehicles move containerised cagro to factories and to Afghanistan from Pakistan’s ports.

Earlier this month, a media report stated that the government had temporarily halted satellite tracking of containers carrying imported goods to Afghanistan from seaports and instead begun monitoring them through human surveillance, a move that may “increase the chances of smuggling”.

PBC raises concerns on reported termination of satellite tracking of Afghan cargo

FBR chairman on Sunday said the live tracking system on vehicles and containers “has not been ended, but is being improved”.

“DG will announce names of the new applicants most probably this week. Tracking sensors will be installed on both the vehicles and on the containers. The new tracking system will be in place within two to three months,” Langrial said.

The ongoing partial manual system to monitor transportation of containerised cargo “is fully satisfied”, according to the FBR chief.

The contract with the previous tracking company was ended after several years “to break its monopoly”, he added.

Responding to another question, Langrial termed Karachi the commercial capital, adding that the port city would continue to take lead in tax collection for having presence of the head offices of many large businesses.

Regarding the house sector, the FBR chief informed that Prime Minister Shehbaz Sharif constituted a task force for the sector.

The main issue in the housing sector is the higher transaction taxes, according to Langrial. “We are doing a review on the subject these days,” the FBR chairman said.

American Dollar Exchange Rate

American Dollar Exchange Rate