WASHINGTON: The Federal Reserve held interest rates steady on Wednesday, as expected, but U.S. central bank policymakers indicated they still anticipate reducing borrowing costs by half a percentage point by the end of this year in the context of slowing economic growth and, eventually, a downturn in inflation.

Taking stock of the Trump administration’s rollout of tariffs, Fed officials actually marked up their outlook for inflation this year, with their preferred measure of price increases expected to end the year at 2.7% versus the 2.5% pace anticipated in December. The Fed targets inflation at 2%.

But they also marked down the outlook for economic growth for this year from 2.1% to 1.7%, with slightly higher unemployment by the end of thIS year.

Policymakers said risks had increased, with a near unanimous sentiment in saying the outlook for the year was muddled.

US Fed expected to sit tight as Trump tariff fears buffet markets

“Uncertainty around the outlook has increased,” the Fed said in a new policy statement that accounts for the first weeks of the new Trump administration and the initial rollout of what White House officials say will ultimately be global tariffs on imported goods. The Fed left its policy rate in the 4.25%-4.50% range.

The Fed also said it will slow the ongoing drawdown of its balance sheet, known as quantitative tightening.

Fed Governor Chris Waller dissented from the policy statement because of the change in balance sheet policy.

Lower growth, higher unemployment

The rate projections matched the expectations set by financial markets ahead of the meeting, and kept intact the Fed’s general outlook that gradually slowing inflation will allow further monetary policy easing.

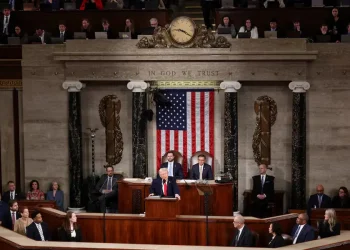

But it may be a rockier road getting there. While not mentioning President Donald Trump or tariffs in the statement, the projections for higher inflation this year coincide with the unveiling of his tariff plans.

It appeared, though, that the Fed for now is looking through the price shift involved in those import taxes, treating them as a one-off change rather than a persistent source of price pressures.

US Fed kicks of rate meeting with economic fears elevated

Underlying inflation beyond 2025 was unchanged from the Fed’s projections in December, expected to return to 2% by the end of 2027.

The projection for rate cuts beyond this year was also unchanged, hitting 3.1% by the end of 2027, near the level seen as having a neutral effect that neither encourages or discourages spending and investment.

The Fed cut its benchmark interest rate by a full percentage point last year, but has kept rates on hold since December as it waits for further evidence that inflation will continue to fall, and, more recently, for more clarity about the impact of Trump’s

policies.

Compared to Trump’s promise of a coming economic “golden age” because of his push to impose tariffs, deport large numbers of immigrants and loosen regulations, the Fed’s outlook forecasts growth at 1.7% this year and just 1.8% in both 2026 and 2027, with the unemployment rate at 4.4% this year and 4.3% in 2026 and 2027. That is above the lows of recent years and above the latest reading of 4.1% in February.

Fed Chair Jerome Powell will hold a press conference at 2:30 p.m. EDT to elaborate on the latest policy statement and projections.

American Dollar Exchange Rate

American Dollar Exchange Rate