WASHINGTON (news agencies) — The Federal Reserve’s favored inflation measure remained low last month, bolstering evidence that price pressures are steadily cooling and setting the stage for the Fed to begin cutting interest rates in September.

Prices rose just 0.1% from May to June, the Commerce Department said Friday, up from the previous month’s unchanged reading. Compared with a year earlier, inflation declined to 2.5% from 2.6%.

Excluding volatile food and energy prices, so-called core inflation rose 0.2% from May to June, up from the previous month’s 0.1%. Measured from one year earlier, core prices increased 2.6%, unchanged from June. Economists closely watch core prices, which typically provide a better read of future inflation trends.

Taken as a whole, Friday’s figures suggest that the worst streak of inflation in four decades, which peaked two years ago, is nearing an end. Fed Chair Jerome Powell has said that this summer’s cooling price data has strengthened his confidence that inflation is returning sustainably to the central bank’s target level of 2%.

Lower interest rates and weaker inflation, along with a still-solid job market, could brighten Americans’ assessment of the economy and influence this year’s presidential race between Vice President Kamala Harris and former President Donald Trump.

Friday’s report also showed that consumer spending ticked higher in June. So did incomes, even after adjusting for inflation. The report suggested that a rare “soft landing,” in which the Fed manages to slow the economy and inflation through higher borrowing rates without causing a recession, is taking place — so far.

“A two-word summary of the report is, ‘good enough,’” said Robert Frick, an economist with the Navy Federal Credit Union. “Spending is good enough to maintain the expansion, and income is good enough to maintain spending. And the level of inflation is good enough to make the decision to cut rates easy for the Fed.”

Consumer spending rose 0.3% from May to June, slightly below the previous month’s 0.4% gain. Incomes rose 0.2%, down from 0.4% in May. Average inflation-adjusted income has risen 1% from a year ago, Friday’s report said, though that figure has slowed from 1.9% at the start of the year.

With the pace of hiring cooling and the economy growing at a steady, if not robust, pace, it’s considered a near-certainty that the Fed will cut its benchmark interest rate when it meets in mid-September. The central bank will first meet next week. Powell is expected to say afterward that the Fed’s policymakers still want to see additional data to be sure that inflation is slowing consistently.

Still, the central bank will likely signal next week that it’s getting closer to reducing borrowing costs.

“I expect Powell will be quite comfortably pointing to September for an easing,” said David Page, head of macro research at AXA IM, a London-based investment manager.

Last month, food prices ticked up just 0.1%, extending a run of slight cost increases after grocery prices had soared in 2021 and 2022. Compared with a year ago, food prices are up just 1.4%.

Energy prices tumbled 2.1% from May to June, led by sharply lower gas prices. Energy costs are up 2% over the past year. New car prices fell 0.6% last month, after having surged during the pandemic.

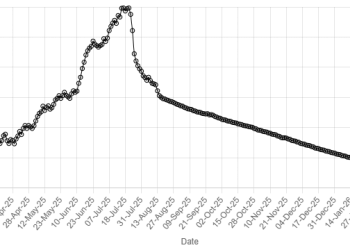

After jumping to 7% in 2022, according to the measure released Friday, inflation has fallen steadily for the past year. Even so, the costs of everyday necessities like groceries, gasoline and rent remain much higher than they were three years ago — a fact that has soured many voters on the Biden-Harris administration’s handling of the economy.

Inflation is cooling even as the economy keeps steadily expanding. On Thursday, the government reported that the U.S. economy grew at a healthy 2.8% annual rate in the April-June quarter, with consumers and businesses spending at a solid pace. That was up from just a 1.4% annual growth rate in the first three months of the year.

Businesses are still adding jobs, though most of the hiring in recent months has been concentrated in just two sectors of the economy: health care and government. The unemployment rate has edged up to a still-low 4.1%, after the longest stretch below 4% in a half-century.