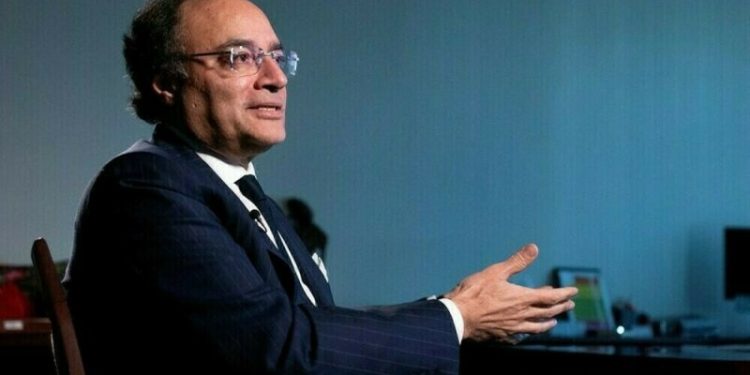

Finance Minister Muhammad Aurangzeb signalled potential easing of Pakistan’s policy rate later this year, noting slowing inflation and stable economic indicators, while addressing the 78th Independence Day of Pakistan and the Marka-e-Haque celebrations at the Rawalpindi Chamber of Commerce & Industry (RCCI) on Wednesday.

“I am always careful that the policy rate and the market-based exchange rate are very much under the purview of the State Bank of Pakistan (SBP) and the Monetary Policy Committee (MPC). Having said that, citing core and average inflation, my personal view is that I do think there is room to do more in terms of the policy rate.

“I am very hopeful that during this calendar year, we will see movement on the policy rate going south,” he said.

Last month, the MPC of the central bank decided to keep the policy rate unchanged at 11%. The decision contradicted market expectations, which had anticipated a rate cut of around 50 to 100 basis points (bps).

The committee, back then, noted that inflation in June 2025 decelerated to 3.2% year-on-year, led mainly by lower food prices, whereas core inflation also declined slightly.

During his address, the finance minister said that the international financial organisations have lauded the government’s economic reform agenda. “S&P and Fitch have already upgraded us, and I am very hopeful that soon the third agency [Moody’s] will also upgrade us,” he said.

Pakistan govt alarmed by over Rs6trn losses in state-owned enterprises

Shifting to trade development, Aurangzeb said the recently announced deal with the United States “provides a fantastic opportunity to capitalise on”.

The government believes that Pakistan’s exporters are poised to gain a significant competitive edge in the US market after the government successfully negotiated a reduction in reciprocal tariffs from 29% to 19%. This marks the lowest tariff rate in the region and presents a major opportunity to boost Pakistan’s exports to the US.

Meanwhile, the finance minister elaborated on his government’s economic performance, saying that in recent years the size of the economy and overall income have increased, there is stability in the financial sector, a record reduction in fiscal deficit and inflation, the current account is in surplus, and a record rise in remittances is registered.

“National security and economic stability are essential for each other, and it is encouraging that over the past one and a half years, we have made strong progress on the economic front,” said Aurangzeb.

He said that last year the government reduced its debt servicing cost by Rs1 trillion. It intends to repeat this feat in the current fiscal year as well, he said.

He said that the transformation in the Federal Board of Revenue (FBR) is underway.

“I am very clear that taxation needs to be brought to a regionally competitive level. We cannot further burden the salaried class and the manufacturing sector,” Aurangzeb maintained.

Finance Minister Muhammad Aurangzeb signalled potential easing of Pakistan’s policy rate later this year, noting slowing inflation and stable economic indicators, while addressing the 78th Independence Day of Pakistan and the Marka-e-Haque celebrations at the Rawalpindi Chamber of Commerce & Industry (RCCI) on Wednesday.

“I am always careful that the policy rate and the market-based exchange rate are very much under the purview of the State Bank of Pakistan (SBP) and the Monetary Policy Committee (MPC). Having said that, citing core and average inflation, my personal view is that I do think there is room to do more in terms of the policy rate.

“I am very hopeful that during this calendar year, we will see movement on the policy rate going south,” he said.

Last month, the MPC of the central bank decided to keep the policy rate unchanged at 11%. The decision contradicted market expectations, which had anticipated a rate cut of around 50 to 100 basis points (bps).

The committee, back then, noted that inflation in June 2025 decelerated to 3.2% year-on-year, led mainly by lower food prices, whereas core inflation also declined slightly.

During his address, the finance minister said that the international financial organisations have lauded the government’s economic reform agenda. “S&P and Fitch have already upgraded us, and I am very hopeful that soon the third agency [Moody’s] will also upgrade us,” he said.

Pakistan govt alarmed by over Rs6trn losses in state-owned enterprises

Shifting to trade development, Aurangzeb said the recently announced deal with the United States “provides a fantastic opportunity to capitalise on”.

The government believes that Pakistan’s exporters are poised to gain a significant competitive edge in the US market after the government successfully negotiated a reduction in reciprocal tariffs from 29% to 19%. This marks the lowest tariff rate in the region and presents a major opportunity to boost Pakistan’s exports to the US.

Meanwhile, the finance minister elaborated on his government’s economic performance, saying that in recent years the size of the economy and overall income have increased, there is stability in the financial sector, a record reduction in fiscal deficit and inflation, the current account is in surplus, and a record rise in remittances is registered.

“National security and economic stability are essential for each other, and it is encouraging that over the past one and a half years, we have made strong progress on the economic front,” said Aurangzeb.

He said that last year the government reduced its debt servicing cost by Rs1 trillion. It intends to repeat this feat in the current fiscal year as well, he said.

He said that the transformation in the Federal Board of Revenue (FBR) is underway.

“I am very clear that taxation needs to be brought to a regionally competitive level. We cannot further burden the salaried class and the manufacturing sector,” Aurangzeb maintained.