Gold extended gains on Tuesday as uncertainty over U.S. President Donald Trump’s tariff plans continued to dominate sentiment, driving safe-haven demand amid fears of a potential global trade war.

Spot gold rose 0.2% to $2,903.56, as of 0301 GMT. U.S. gold futures gained 0.6% to $2,916.80.

“We’ve seemingly got pretty significant central bank buying and that we’ve also got these potential shortages in Europe on the basis that there seems to be a rush to get gold in the U.S., to avoid possible tariffs,” Capital.com’s financial market analyst Kyle Rodda said.

“I think the trend remains bullish for gold – the fundamentals are good.”

Since his inauguration, Trump has imposed a 10% tariff on Chinese imports, announced and delayed 25% tariffs on goods from Mexico and non-energy imports from Canada, set a date for 25% tariffs on imported steel and aluminium, and is planning reciprocal tariffs on all countries taxing U.S. imports.

U.S. Federal Reserve Governor Michelle Bowman said on Monday she wanted increased conviction that inflation will ease further this year before lowering interest rates again, particularly given uncertainty around the new trade and other policies.

Bullion is viewed as a traditional hedge against rising inflation and economical uncertainties.

Two Fed officials are scheduled to speak later in the day to give further insights on monetary policy trajectory.

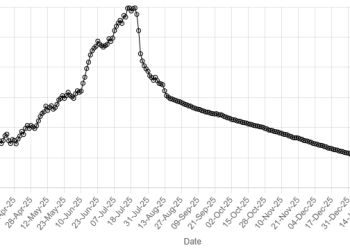

Gold prices make noticeable recovery

Goldman Sachs raised its gold price forecast to $3,100 per ounce from $2,890 per ounce for end-2025 on structurally higher central bank demand.

On Monday, European leaders meeting in Paris called for higher spending to ramp up the continent’s defence capabilities but remained split on the idea of deploying peacekeepers to Ukraine to back up any peace deal.

Spot silver fell 1.5% to $32.30 an ounce. Platinum gained 0.7% to $981.86, and palladium climbed 1.3% to $974.75.

American Dollar Exchange Rate

American Dollar Exchange Rate