Gold steadied near a record high on Thursday, as softer-than-expected US producer prices data reinforced expectations of a Federal Reserve interest rate cut next week, while investors awaited US consumer inflation data due later in the day.

Spot gold held its ground at $3,636.59 per ounce, as of 0233 GMT.

Bullion hit a record high of $3,673.95 on Tuesday.

US gold futures for December delivery edged down 0.1% to $3,676.40.

“Weak US macro data has been fueling gold’s recent climb; both the massive revisions to the labor data as well as the positive surprise in the PPI readings are leading to expectations that the Fed will lower rates at a much faster clip than previously expected,” said Marex analyst Edward Meir.

US producer prices unexpectedly fell in August due to lower trade services margins and modest increases in goods costs.

Investors are now focused on US Consumer Price Index (CPI) data, due at 1230 GMT, with a Reuters poll forecasting a 0.3% monthly increase in August following a 0.2% rise in July.

CPI is expected to have grown 2.9% year-on-year, compared with 2.7% in July. Unless CPI surprises negatively, it should continue to push prices higher, Meir said.

Weaker-than-expected nonfarm payroll data last week, along with revised estimates revealing 911,000 fewer jobs in the 12 months through March, have reinforced expectations of monetary easing.

Investors are also watching for weekly jobless claims data, due at 1230 GMT, for additional insight into the US labor market.

The Fed is widely anticipated to cut interest rates by 25 basis points at its meeting next Wednesday, while investors also priced in a slim possibility of 50-basis-point reduction, as per CME FedWatch tool.

Gold, which does not yield interest, tends to perform well in low-interest-rate environments.

Meanwhile, US President Donald Trump’s administration appealed on Wednesday a federal judge’s ruling that temporarily blocked the dismissal of Fed Governor Lisa Cook.

Elsewhere, spot silver was down 0.1% at $41.09 per ounce.

Platinum steadied at $1,386.75 and palladium fell 0.1% to $1,172.

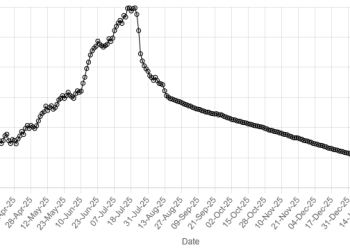

American Dollar Exchange Rate

American Dollar Exchange Rate