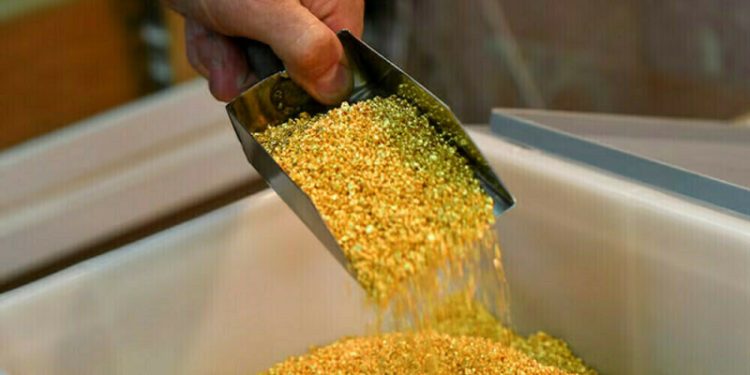

Gold held above the key $3,000/oz level on Wednesday, trading near a record high hit in the previous session, as Middle East tensions and trade uncertainties lifted bullion’s appeal, while traders awaited the Federal Reserve’s decision later in the day.

Spot gold held its ground at $3,029.70 an ounce, as of 0230 GMT, after hitting an all-time peak of $3,038.26 on Tuesday.

“The current trading environment, where there are worries about tariffs, growth and inflation, is playing to gold’s strengths as an uncertainty hedge,” KCM Trade chief market analyst Tim Waterer said.

Investors are worried about an economic slowdown and elevated risks of recession due to US President Donald Trump’s tariffs, which are widely considered likely to stoke inflation.

The tariffs have flared up trade tensions and include a flat 25% levy on steel and aluminium, which came into effect in February, and reciprocal and sectoral tariffs to be imposed on April 2.

The Fed, which will conclude its two-day policy meeting later in the day, is expected to hold its benchmark interest rate steady in the 4.25%-4.50% range.

Non-yielding gold thrives in a low interest rate environment.

“If the FOMC meeting takes on a dovish tone in response to growing uncertainty over how tariffs may impact growth, this could provide a further assist to the gold price … could be a green light for gold to make a push above $3,050,” Waterer said.

Gold scales record peak, rises above $3,000 again as tariff uncertainty fuels safe-haven demand

Elsewhere, Israeli airstrikes pounded Gaza and killed more than 400 people on Tuesday, Palestinian health authorities said, shattering nearly two months of relative calm since a ceasefire began, as Israel warned the onslaught was “just the beginning.”

Spot silver fell 0.3% to $33.92 an ounce, platinum lost 0.5% to $991.80 and palladium shed 0.7% to $960.75.

American Dollar Exchange Rate

American Dollar Exchange Rate