Gold prices climbed on Friday and were poised for a fourth straight monthly rise, bolstered by investor optimism that the US Federal Reserve would cut interest rates in December.

Spot gold rose 0.8% to $4,189.61 per ounce by 0303 GMT, hitting its highest since November 14, and was set for a 3% weekly gain.

Bullion is set to register a 3.9% rise this month. US gold futures for December delivery were up 0.5% at $4,221.30 per ounce.

“Trading conditions are looking a bit thin liquidity-wise, which is exacerbating some of the market moves.

A lot of the moves higher in gold are due to pre-positioning in anticipation of a lower interest rate environment,“ said KCM Trade Chief Market Analyst Tim Waterer.

US rate futures are pricing in an 87% chance of a rate cut in December, compared with 85% a day prior and 50% a week before, according to the CME’s FedWatch tool.

Comments from San Francisco Federal Reserve Bank President Mary Daly and Fed Governor Christopher Waller this week have bolstered expectations for a rate cut next month.

Like US President Donald Trump, Kevin Hassett, who has emerged as a front runner to replace Jerome Powell as Fed Chair, has also said interest rates should be lower.

Their stance, however, contrasted with several regional Fed presidents advocating a pause until inflation shows a more convincing move towards the US central bank’s 2% target.

Non-yielding gold tends to perform well in low-interest-rate environments.

The US dollar was headed for its worst week since late July.

A weaker greenback makes dollar-priced gold more attractive for buyers using other currencies.

Investors say that Hassett at the Fed’s helm could pressure the dollar.

Elsewhere, spot silver rose 1.4% to $54.18 per ounce and platinum gained 1.7% to $1,634.82, with both up 7.4% for the week.

Palladium lost 0.6% to $1,428.62 but was set for a 4% weekly gain.

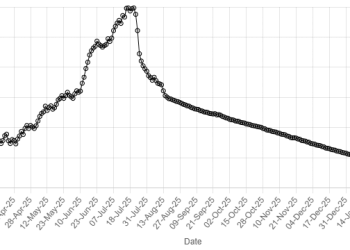

American Dollar Exchange Rate

American Dollar Exchange Rate