Gold prices held steady on Friday and were poised for a seventh consecutive weekly gain as US President Donald Trump’s plans to impose reciprocal tariffs on every country taxing US imports fuelled concerns of a global trade war.

Spot gold held its ground at $2,927.50 per ounce, as of 0534 GMT. Bullion hit a record peak of $2,942.70 on Tuesday.

US gold futures rose 0.4% to $2,956.30.

On Thursday, Trump tasked his economics team with devising plans for reciprocal tariffs on every country taxing US imports, and the targets include China, Japan, South Korea and the European Union.

A major trigger for gold prices this week was Trump’s announcement to impose reciprocal tariffs, which is creating tariff war concerns and could impact global economies, said Ajay Kedia, director at Mumbai-based Kedia Commodities.

Gold rises on trade war jitters

The market is slightly overbought, which can create some technical profit booking after nearing the $3,000 level, Kedia said.

Meanwhile, data on Thursday showed the US producer price index (PPI) saw a strong increase in January, following Wednesday’s inflation report that revealed consumer prices had risen at the fastest pace in nearly a year and a half.

The PPI data offered more evidence that inflation was accelerating again and strengthened views that the Federal Reserve would not cut interest rates before the second half of the year.

Bullion is traditionally viewed as a safe haven against inflation and economic uncertainty, but the appeal of this non-yielding asset diminishes with rising interest rates.

US-China trade breakthrough, de-escalation in Russia-Ukraine or Israel-Hamas conflicts, or strong US data that takes Fed rate cuts off the table for this year are possible reasons for gold prices to drop and all seem to be unlikely in the near term, said Ilya Spivak, head of global macro at Tastylive.

Spot silver gained 0.6% to $32.54 per ounce. Platinum was up 0.2% at $997.46 and palladium rose 0.2% to $996.24. All three metals were set for a weekly gain.

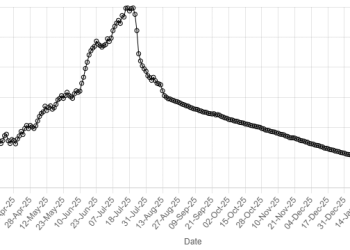

American Dollar Exchange Rate

American Dollar Exchange Rate