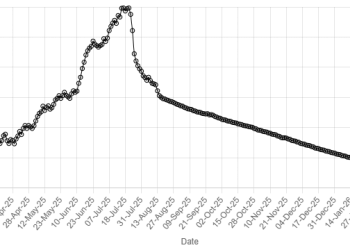

Gold prices remained steady on Monday and was trading slightly below the key $2,500 an ounce level, as the market awaited August inflation data for further insights into the anticipated Federal Reserve interest rate cut this month.

Gold price per tola decreases Rs2,000 in Pakistan

Fundamentals

Spot gold was nearly unchanged at $2,497.53 per ounce, as of 0021 GMT. US gold futures edged 0.1% higher to $2,526.40.

Data on Friday showed that nonfarm payrolls increased by 142,000 jobs last month after a downwardly revised 89,000 rise in July. Economists polled by Reuters had forecast payrolls increasing by 160,000 jobs.

Fed policymakers signalled they are ready to kick off a series of interest rate cuts at the US central bank’s meeting in two weeks.

Their (Fed officials) remarks suggested a likely quarter-point rate cut, with potential for larger reductions if the job market weakens further.

Fed funds futures traders are now pricing a 71% chance of a 25 basis point cut at the Fed’s Sept. 17-18 meeting, and a 29% chance of a 50 bp reduction, according to the CME FedWatch Tool.

A low interest rate environment tends to boost non-yielding bullion’s appeal.

This week, traders will be watching for the August US Consumer Price Index (CPI) due on Wednesday, followed by Producer Price Index (PPI) on Thursday.

Meanwhile, China’s central bank held back on buying gold for its reserves for a fourth straight month in August, official data showed on Saturday.

Elsewhere, gold discounts in India surged to a seven-week high last week as rising prices hurt demand, while traders and analysts noted that Asian consumers would likely utilise any price declines.

Spot silver rose 0.3% to $28.01 per ounce, platinum gained 0.3% to $924.02 and palladium was up nearly 1% at $919.76.