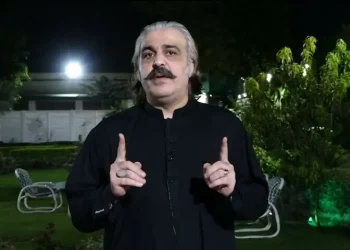

Federal Minister for Finance and Revenue Muhammad Aurangzeb has said that the government will look at how the salaried group can be protected after new measures increased its tax burden in the recently announced Budget 2024-25.

Talking to Geo News on Thursday, the finance minister said the government tried to “ring-fence the salaried class as much as it could”.

“I agree,” said Aurangzeb as he responded to a question on taxing Pakistan’s salaried group further. “I have worked for six years, I know what the tax brackets were, what the super tax was, what CVT was imposed.

“We made a lot of effort to protect them.”

Aurangzeb said persons earning less than Rs600,000 annually remained exempted from income tax.

“We also protected the highest bracket of 35%. We could have imposed more taxes on this segment, but they were protected as we feared talent would leave the country,” he said.

“We are reviewing how much relief we can provide to the tax slabs,” he said.

The Finance Minister said as the government targets to increase its tax revenue from Rs9.4 trillion to Rs12.9 trillion, it needs to increase its revenue by Rs3.5 trillion.

“We will generate Rs1.5 trillion through additional revenue measures by removing exemptions and imposing more taxes,” he said.

Aurangzeb shared the total impact of the additional tax measures on the salaried class is around Rs70 billion out of Rs1.5-1.6 trillion.

The remarks come after the government increased tax liability for all persons earning more than Rs50,000 a month in Budget 2024-25.

American Dollar Exchange Rate

American Dollar Exchange Rate