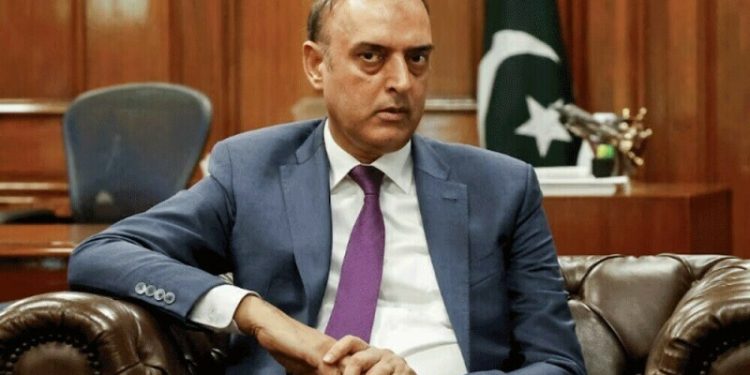

State Bank of Pakistan (SBP) Governor Jameel Ahmad said the decline in key policy rate will help the government save Rs1.5 trillion in interest payments this fiscal year (FY25).

The remarks from the central bank chief came while talking to a private news channel late on Monday.

“When the budget was formulated, the projected rate was on the higher side, as the prevailing rate at that time was 22%. However, considering that the policy rate has now decreased to 13%, and the government is currently borrowing at approximately 12%, we have reassessed the situation accordingly,” said the SBP governor.

“We believe that the interest payment of Rs9.8 trillion budgeted for this fiscal year will come down to Rs8.3 trillion, resulting in a saving of Rs1.5 trillion for the government in budgeted interest payments,” he said.

“This would also allow the government to successfully meet its fiscal deficit level of 6%,” the central bank chief added.

The remarks come after the Monetary Policy Committee (MPC) of the SBP on Monday reduced the key policy rate by 200 basis points (bps) to take it down to 13%. This was the fifth successive cut since June 2024 when the rate stood at 22%.

“Headline inflation declined to 4.9% y/y in November 2024, in line with the MPC’s expectations,” the MPC said in its statement.

“This deceleration was mainly driven by continued decline in food inflation as well as the phasing out of the impact of the hike in gas tariffs in November 2023.

“However, the Committee noted that core inflation, at 9.7%, is proving to be sticky, whereas inflation expectations of consumers and businesses remain volatile. To this effect, the Committee reiterated its previous assessment that inflation may remain volatile in the near term before stabilizing in the target range.

“Overall, the Committee assessed that its approach of measured policy rate cuts is keeping inflationary and external account pressures in check, while supporting economic growth on a sustainable basis.”

Meanwhile, in the post-MPC analyst briefing session, the SBP said that for FY25, Pakistan’s total external debt obligations are estimated at $26.1 billion, comprising $22.1 billion in principal repayments and $4 billion in interest.

As per brokerage house Arif Habib Limited, which attended the session, the central bank shared that $10.4 billion (including $5.4 billion in rollovers) has already been either repaid or rolled over. A significant portion of the remaining debt is also expected to be rolled over, with ~$5 billion projected to be repaid during the rest of FY25.

Meanwhile, talking to the private channel on Monday, the SBP governor mentioned that being under the International Monetary Fund (IMF) programme, Pakistan’s bilateral partners have assured the country and the Washington-based lender “that they will continue to roll over their deposits for the programme duration i.e. till June 2027.”

State Bank of Pakistan (SBP) Governor Jameel Ahmad said the decline in key policy rate will help the government save Rs1.5 trillion in interest payments this fiscal year (FY25).

The remarks from the central bank chief came while talking to a private news channel late on Monday.

“When the budget was formulated, the projected rate was on the higher side, as the prevailing rate at that time was 22%. However, considering that the policy rate has now decreased to 13%, and the government is currently borrowing at approximately 12%, we have reassessed the situation accordingly,” said the SBP governor.

“We believe that the interest payment of Rs9.8 trillion budgeted for this fiscal year will come down to Rs8.3 trillion, resulting in a saving of Rs1.5 trillion for the government in budgeted interest payments,” he said.

“This would also allow the government to successfully meet its fiscal deficit level of 6%,” the central bank chief added.

The remarks come after the Monetary Policy Committee (MPC) of the SBP on Monday reduced the key policy rate by 200 basis points (bps) to take it down to 13%. This was the fifth successive cut since June 2024 when the rate stood at 22%.

“Headline inflation declined to 4.9% y/y in November 2024, in line with the MPC’s expectations,” the MPC said in its statement.

“This deceleration was mainly driven by continued decline in food inflation as well as the phasing out of the impact of the hike in gas tariffs in November 2023.

“However, the Committee noted that core inflation, at 9.7%, is proving to be sticky, whereas inflation expectations of consumers and businesses remain volatile. To this effect, the Committee reiterated its previous assessment that inflation may remain volatile in the near term before stabilizing in the target range.

“Overall, the Committee assessed that its approach of measured policy rate cuts is keeping inflationary and external account pressures in check, while supporting economic growth on a sustainable basis.”

Meanwhile, in the post-MPC analyst briefing session, the SBP said that for FY25, Pakistan’s total external debt obligations are estimated at $26.1 billion, comprising $22.1 billion in principal repayments and $4 billion in interest.

As per brokerage house Arif Habib Limited, which attended the session, the central bank shared that $10.4 billion (including $5.4 billion in rollovers) has already been either repaid or rolled over. A significant portion of the remaining debt is also expected to be rolled over, with ~$5 billion projected to be repaid during the rest of FY25.

Meanwhile, talking to the private channel on Monday, the SBP governor mentioned that being under the International Monetary Fund (IMF) programme, Pakistan’s bilateral partners have assured the country and the Washington-based lender “that they will continue to roll over their deposits for the programme duration i.e. till June 2027.”