Most stock markets in the Gulf were subdued on Thursday as signs of U.S. economic resilience dampened expectations for aggressive interest rate cuts in the near term.

The U.S. Federal Reserve’s December policy meeting, released on Wednesday, showed officials were concerned that U.S. President-elect Donald Trump’s proposed tariffs and immigration policies may prolong the fight against inflation.

Fed decisions have a significant impact on the Gulf region’s monetary policy as most of the region’s currencies are pegged to the dollar. Markets are fully pricing in just one 25 basis point rate cut in 2025, and see around a 60% chance of a second.

Saudi Arabia’s benchmark index reversed early losses to nudge 0.1% higher, helped by a 3.9% jump in Dr Sulaiman Al Habib Medical Services.

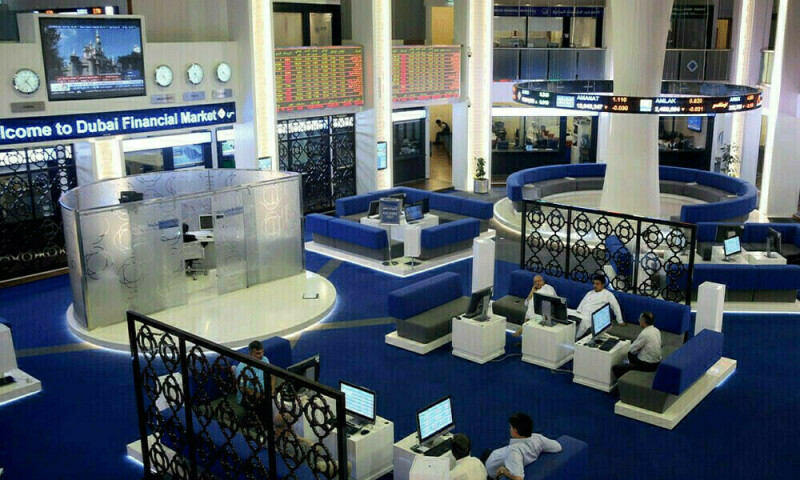

Most Gulf markets in red on US rate outlook

Separately, the kingdom’s crude oil supply to China is set to decline in February from the month before, trade sources said on Thursday, after it hiked its prices and as OPEC+ extended production cuts in the first quarter.

In Qatar, the index dropped 0.1%, hit by a 0.8% fall in the Gulf’s biggest lender Qatar National Bank.

The Abu Dhabi index finished flat.

Dubai’s main share index gained 0.4%, with utility firm Dubai Electricity and Water Authority rising 1.4%.

Outside the Gulf, Egypt’s blue-chip index declined 1.2%, weighed down by a 2% slide in Commercial International Bank.

—————————————

SAUDI ARABIA rose 0.1% to 12,098

Abu Dhabi was flat at 9,463

Dubai added 0.4% to 5,229

QATAR eased 0.1% to 10,442

EGYPT fell 1.2% to 29,445

BAHRAIN lost 0.2% to 1,973

OMAN closed flat at 4,598

KUWAIT was up 0.6% to 8,024

—————————————