Stock markets in the Gulf ended mixed on Monday, weighed down by weaker oil prices, while investors awaited further clarity on the U.S. interest rate outlook.

Oil prices, a catalyst for the Gulf’s financial markets, dropped on Monday, extending losses from last week, as Russia-Ukraine peace talks edged closer to a solution and the greenback strengthened.

Hopes for a Russia-Ukraine deal raised the prospect of easing sanctions, potentially freeing up more Russian supply.

Saudi Arabia’s benchmark index retreated 1.4%, with Al Rajhi Bank declining 2.6% and oil behemoth Saudi Aramco losing 1.4%.

Market sentiment was dampened by lower oil prices and oversupply concerns. Reports of potential progress toward peace in Eastern Europe raised the prospect of Russian crude returning to the market, adding further pressure on crude prices, said Hani Abuagla Senior Market Analyst at XTB MENA.

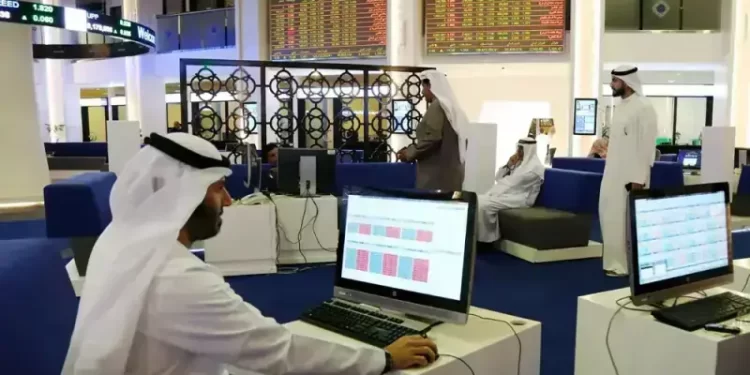

Dubai’s main share index inched 0.1% lower.

Dubai Financial Market delayed the start of the trading session on Monday due to connectivity issues affecting participants.

In Abu Dbabi, the index was down 0.2%.

The probability of a Fed rate cut next month inched lower to 69% on Monday, after jumping to 74% in the previous session, according to the CME FedWatch Tool.

Investors await the release of U.S. retail sales and producer prices data, due later in the week.

Bets of rate cuts had surged to 74% from 40% on Friday following dovish comments from New York Fed President John Williams.

U.S. monetary policy shifts have a significant impact on Gulf markets, where most currencies are pegged to the dollar.

The Qatari index rose 0.4%, with Qatar Islamic Bank gaining 1.3%.

According to Abuagla, the high probability of a Fed rate cut is aiding sentiment, the market will likely need further positive developments to sustain a recovery.

Outside the Gulf, Egypt’s blue-chip index tumbled 1.8%, with tobacco monopoly Eastern Company dropping 6.3%.

Saudi Arabia | declined 1.4% to 10,852 |

Abu Dhabi | dropped 0.2% to 9,772 |

Dubai | eased 0.1% to 5,831 |

Qatar | gained 0.4% to 10,700 |

Egypt | down 1.8% to 39,725 |

Bahrain | added 0.3% to 2,038 |

Oman | was up 0.7% to 5,637 |

Kuwait | rose 0.1% to 9,403 |

American Dollar Exchange Rate

American Dollar Exchange Rate