Stock markets in the Gulf tracked global shares to end higher on Wednesday, after the US producer price data pointed to inflation cooling, which supported speculation that the Federal Reserve could cut rates soon.

Markets are pricing in a roughly 51.5% chance of a 50 basis point rate cut, and a 48.5% chance of a 25 basis point cut, at the Fed’s next meeting in September.

Monetary policy in the six-member Gulf Cooperation Council (GCC) is usually guided by the Fed’s decisions, as most regional currencies are pegged to the US dollar.

Major Gulf market mixed ahead of US data, oil demand concerns

Dubai’s benchmark stock index was up 0.7%, lifted by gains in most sectors with Emirates NBD, the emirate’s largest lender, rising 2.1% and toll operator Salik Company advancing 1.5%.

Salik said on Tuesday it will distribute all of its first half-year net profit after tax as dividend, equaling 7.263 fils per share.

The Abu Dhabi benchmark index bounced back after two straight sessions of loss, rising 0.6%. The conglomerate International Holding gained 1% and Abu Dhabi National Energy was up 1.5%. The state-owned energy firm TAQA reported a 17.7% rise in quarterly net profit.

Saudi Arabia’s benchmark stock index was up for a second consecutive session, increasing 0.5%, with most of its constituents posting gains. Al Taiseer Group climbed 6.8% and Middle East Pharmaceutical advanced 2.5%.

The Qatari benchmark index advanced 0.4%, helped by communication, finance and materials sectors with the region’s largest lender Qatar National Bank rising 1.9% and telecom operator Ooredoo climbing 3.9%.

However, Qatar Navigation slid 0.7% after the maritime and logistics firm reported on Tuesday a slight dip in half-year net profit.

Outside the Gulf, Egypt’s blue-chip index was up 0.8%, with most sectors in the green. Commercial International Bank rose 1.2%, while Misr Fertilizers Production surged 10.3% after it reported a 200% surge in quarterly net profit.

SAUDI ARABIA up 0.5% to 11,850

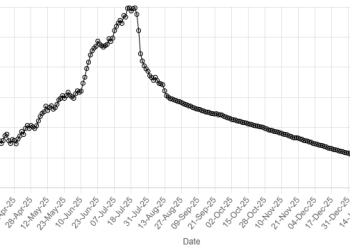

American Dollar Exchange Rate

American Dollar Exchange Rate