Most Gulf equities slipped on Tuesday in tandem with a decline in global stock markets ahead of key U.S. data releases this week, while weaker oil prices also weighed on sentiment.

Crude prices, a key driver for Gulf financial markets, tumbled more than $1 to below $60 a barrel, the lowest since May.

The Qatari benchmark index fell for a third straight session, losing 0.3% with all constituents in negative territory. Qatar Gas Transport dropped 1.8% and Dukhan Bank declined 1.3%.

Saudi Arabia’s benchmark stock index lost 1.3% to end at 10,453, its lowest level in three months, with all sectors in decline. Al Rajhi Bank, the world’s largest Islamic lender, fell 2.1% and oil major Saudi Aramco shed 1%.

“A significant driver of today’s decline was the drop in oil prices, which broke through key support levels,” said Daniel Takieddine, co-founder and CEO of Sky Links Capital Group.

“This confirms the potential for further downside as the geopolitical risk premium fades, on speculation that the Russia-Ukraine conflict may be nearing a resolution.”

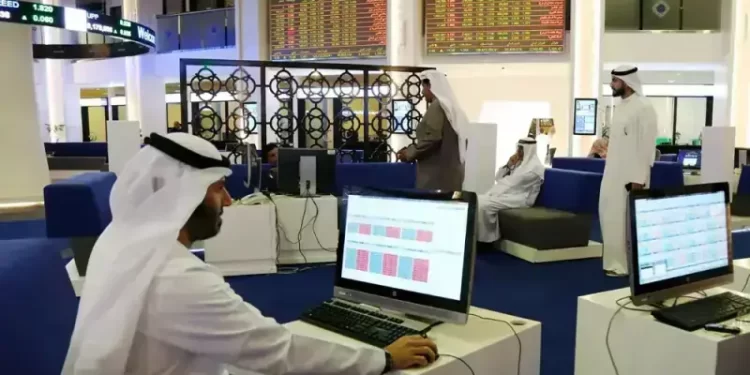

The Abu Dhabi benchmark index was down for a third session, edging 0.1% lower with most constituents posting losses, led by consumer staples and energy. ADNOC Drilling and ADNOC Distribution fell 1.3% each, while ADNOC Gas eased 0.9%.

Meanwhile, Abu Dhabi National Oil Company (ADNOC) said on Monday it has secured a controlling 95% stake in Covestro in its 14.7-billion-euro takeover, one of the largest acquisitions of an EU company by a Gulf state.

Dubai’s benchmark stock index snapped two sessions of losses to close 0.3% higher, supported by a 1.4% gain in Emaar Properties and a 1.3% rise in toll operator Salik Company.

Market attention is focused on U.S. employment reports for October and November due later on Tuesday, as well as an inflation reading on Thursday, that could help gauge the Federal Reserve’s policy path next year.

U.S. monetary policy moves are closely watched in the Gulf, where most currencies are pegged to the dollar.

Outside the Gulf, Egypt’s blue-chip index fell 0.7% after two straight sessions of gains, with most stocks in the red. Telecom Egypt slid 3.2% and E-Finance For Digital And Financial Investements dropped 4%.

| SAUDI ARABIA | dropped 1.3% to 10,453 |

|---|---|

| KUWAIT | lost 0.7% to 9,580 |

| QATAR | fell 0.3% to 10,727 |

| EGYPT | down 0.7% to 42,002 |

| BAHRAIN | up 0.1% to 2,058 |

| OMAN | fell 1% to 5,928 |

| ABU DHABI | down 0.1% to 9,980 |

| DUBAI | rose 0.3% to 6,110 |

American Dollar Exchange Rate

American Dollar Exchange Rate