MUMBAI: Indian government bonds extended losses in early trade on Friday as traders stayed cautious ahead of the weekly debt auction, following a sharp sell-off the previous day after hawkish comments from the US Federal Reserve.

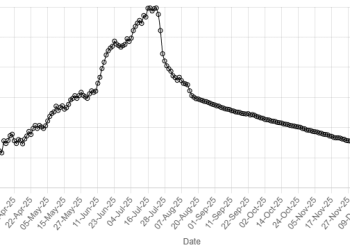

The yield on the benchmark 10-year note was at 6.5863% as of 10:30 a.m. IST.

It settled at 6.5730% on Thursday, its highest close since September 30 and the biggest single day jump in six weeks.

Bond yields rise when prices fall. New Delhi is set to sell bonds worth 320 billion rupees ($3.6 billion) including 50 billion rupees of 29-year old green bonds.

“Demand at the auction will be crucial, but it is unlikely to drive 10-yr yield below 6.55%,” a trader at a private bank said.

“We have oversold and are looking for strong catalysts to resume buying.”

The Indian 10-year yield broke crucial level of 6.55% on Thursday, after US Federal Reserve Chair Jerome Powell signalled in his speech that a December rate cut was not yet a done deal, even as the market had widely priced it in.

The following rout in US Treasuries spilled into India bonds, already hurt by supply-demand concerns and tight liquidity.

India’s banking system liquidity has swung between deficit and surplus in the past few weeks, with negligible net liquidity injections amid the RBI’s interventions to anchor the rupee.

A shrinking banking system liquidity in the market has kept the volumes thin, traders said.

Traders are also tracking a potential US-India trade deal that could reduce tariff impact on growth and have a bearing on the rate easing trajectory.