Indian government bonds edged lower early on Thursday, as traders avoided building positions ahead of Friday’s debt sale amid uncertainty over on the central bank’s rate-cut and liquidity path.

The benchmark 10-year yield was 6.5450% as of 10:45 a.m. IST, after ending at 6.5323% on Wednesday.

The Reserve Bank of India is set to sell bonds worth 300 billion rupees ($3.38 billion) on Friday, including a 5-year and 50-year paper.

The auction is seen as a key test of long-end demand and a cue on whether the benchmark yield curve will flatten, traders said.

The yield on the 30- to-50 year bonds eased in the last two sessions on speculation that India’s fully accessible route (FAR) government bonds could be added to Bloomberg Global Aggregate Index following reports by local media outlet Business Standard.

With inflation benign and uncertainty over a US-India trade deal, markets are focused on the RBI’s policy-easing path.

“The Reserve Bank of India’s policy move is key now… That will determine the direction for bonds,” said Debendra Kumar Dash, senior vice president of treasury at AU Small Finance Bank.

Focus is also on the prospect of fresh liquidity injections by the central bank in December, especially after recent bond purchases appeared aimed at replacing maturities rather than compressing yields.

Purchases by the “others” group, which includes the RBI, slumped to about 6.8 billion rupees on Wednesday, compared with the daily average of 50 billion rupees in the week ended November 7, when the central bank resumed on-screen buying after six months, CCIL data showed.

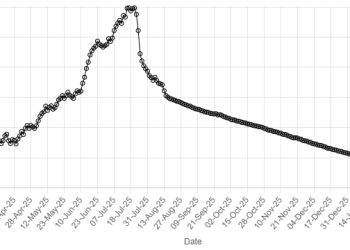

American Dollar Exchange Rate

American Dollar Exchange Rate